Instability Continues

US stock markets were under pressure again on Tuesday. The ongoing sell-off in stocks increased the anxiety of investors who fear the negative impact of new tariff threats on the global economy.

The trading session was held in conditions of high volatility. Concerns about tariffs were replaced by short-term hopes for a resolution of the conflict between Russia and Ukraine, which supported quotes for a moment. However, this effect was short-lived.

Market on the brink of correction

The key S&P 500 index (.SPX) recorded a decline to 5,528.41 points, approaching the mark that is traditionally considered a market correction - a 10% drop from the record closing high of 6,144.15, recorded on February 19.

Additional pressure on the market was exerted by the statement of former US President Donald Trump about raising tariffs on Canadian steel and aluminum to 50%, which will come into effect in the coming hours.

Forecasts are worsening

Analysts at Goldman Sachs responded to the instability by revising the forecast for the S&P 500 index for the end of 2025. Now their estimate is 6,200 points instead of the previously expected 6,500. The main risk factors are uncertainty in tariff policy and a possible slowdown in economic growth.

Even with the new forecast, the 6,200 level remains above the last recorded close of 5,572.07, but there is less and less confidence that it will be reached.

Trillions Down

Another worrying sign was the sharp one-day decline in the S&P 500 on Monday. It was the biggest one-day drop since December 18, wiping out a whopping $4 trillion from the market's recent peak.

Is a Recession Coming?

A new wave of tariff threats is causing fears among investors. Trump's economic policies, including tariffs on Canada, Mexico and China, could put serious pressure on economic growth. The risks of an economic slowdown or even a recession are becoming increasingly real.

The stock market remains in a state of heightened anxiety, with investors watching closely to see what happens next.

Trillions Lost in a Day

US stock markets have started the week with a massive drop. On Monday, the S&P 500 posted its steepest daily decline since Dec. 18, wiping out more than $1.3 trillion in market value. Losses since its last peak have now topped a staggering $4 trillion.

The tech-heavy Nasdaq also found itself in correction territory, down 10% from its previous highs. Overall, the S&P 500 has lost more than 3.4% over the past two trading days, its worst performance since August.

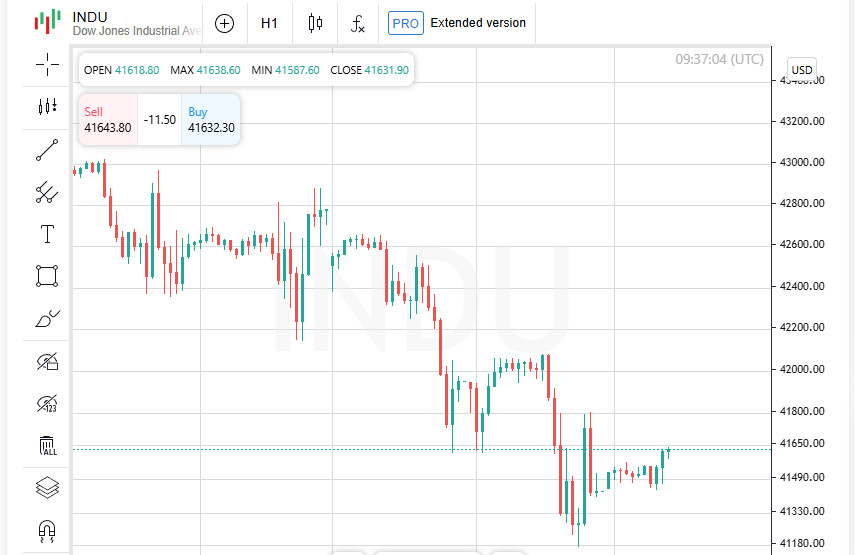

Major Indexes Slip

Markets remained under pressure, however, with leading benchmarks ending lower.

- The Dow Jones Industrial Average (.DJI) fell 478.23 points, or -1.14%, to 41,433.48;

- The S&P 500 (.SPX) lost 42.49 points (-0.76%), closing at 5,572.07;

- The Nasdaq Composite (.IXIC) fell 32.23 points (-0.18%) and ended the session at 17,436.10.

The market is balancing on the edge

Investors continue to analyze potential risks associated with geopolitical and economic factors. The threat of escalating trade wars, instability in international relations and uncertainty about US economic policy form an explosive cocktail that can put prolonged pressure on the stock market.

In the coming days, the attention of market participants will be riveted on further decisions by the White House, the reaction of global economies and macroeconomic data, which can provide new guidelines for market movement.

Markets in chaos due to Trump's policies

Financial markets around the world have experienced a serious shock after the latest statements by Donald Trump. His initiative to introduce retaliatory tariffs against major trading partners has caused a sharp reaction from investors. At the same time, economic indicators are giving alarming signals: fresh data indicate a possible weakening of the American economy.

Market participants' attention is now focused on consumer price statistics, which will be published on Wednesday. This report should show whether inflation has been slowed, which may affect further decisions by the Federal Reserve.

Jobs Market Shows Job Openings Rising

Despite the gloomy outlook, the U.S. Labor Department reported an increase in job openings in January. This may indicate continued strength in the labor market, but it is unclear whether this factor will support the economy in the long term.

Big Sectors in the Red

All 11 major sectors of the S&P 500 index ended trading in the red. However, the least affected sectors were technology (.SPLRCT) and consumer durables (.SPLRCD), which already showed the worst dynamics since the beginning of the year.

Rising uncertainty over U.S. trade policy is also undermining consumer sentiment, with executives of large companies increasingly saying that tariff instability could negatively affect future business earnings.

Retailers suffer losses

Among the companies hit by the market decline, large retail chains were first and foremost.

- Kohl's (KSS.N) warned of a bigger-than-expected drop in full-year same-store sales, sending its shares tumbling 24.1%;

- Dick's Sporting Goods (DKS.N) fell 5.7% after issuing a downbeat full-year outlook.

Airlines hit hard

The economic uncertainty has also hit the airline sector.

- Delta Air Lines (DAL.N) plunged 7.3% after halving its first-quarter profit forecast;

- American Airlines (AAL.O) fell 8.3% after reporting a bigger-than-expected loss.

The broader airline downturn sent the Dow Transportation (.DJT) down 3.1%.

Tech has also buckled under the pressure, with big tech companies also affected.

- Oracle (ORCL.N) fell 3.1% after the cloud giant reported earnings that missed its quarterly revenue forecast.

Volatility is on the rise

Investors remain on edge as they wait for further developments. Political uncertainty, worsening economic outlooks, and rising tariff risks are creating a highly volatile environment for the stock market. The coming days will depend on macroeconomic data and possible regulatory announcements that could impact further price movements.

Citi Weakens Positions on US Stocks

Financial analysts continue to revise their forecasts amid instability in the stock market. Investment bank Citi has become the latest brokerage to downgrade its recommendation on US stocks to neutral, indicating that market participants are increasingly skeptical about growth prospects given the impact of tariff policy and the risks of an economic slowdown.

Trump is steadfast in his tariff strategy

Despite wild market gyrations and investor concerns, Donald Trump is standing firm on his tariff strategy. He met with the CEOs of the largest U.S. corporations on Tuesday, saying tariffs could be increased if economic circumstances warrant.

The meeting was part of a Business Roundtable meeting attended by the CEOs of giants such as Apple (AAPL.O), JPMorgan Chase (JPM.N) and Walmart (WMT.N). Many of these companies have already felt the negative impact of market turmoil caused by fears of recession and rising inflation.

The day before, Trump also held closed-door talks at the White House with representatives of the tech sector, discussing the impact of tariff policy on the industry.

Time to Invest - Trump's Statement

Before the meeting, Trump publicly dismissed the market volatility, saying investors should view the current situation as an opportunity. He promised that over time, the financial losses would turn into gains for those who do not panic.

Cutting Taxes and Easing Regulations

A portion of the meeting closed to the press yielded some surprising announcements. According to people familiar with the discussions, Trump promised to speed up environmental approvals for projects and cut corporate taxes to 15% for companies that set up production in the U.S.

The move is intended to encourage businesses to localize production and reduce their reliance on overseas supplies, especially from China and Mexico.

New Tariffs and Global Trade Strategy

Earlier, Trump had already imposed an additional 20% tariff on Chinese goods, as well as 25% tariffs on imports from Canada and Mexico. However, for North American neighbors, most tariffs have been temporarily suspended until April 2.

Trump plans to introduce a new global tariff regime by that date, which will affect all US trading partners. This means that global markets could face even more serious shocks if the US administration's new strategy turns out to be tougher than expected.

The business community is watching the developments with concern. The increase in tariffs is already putting pressure on international trade, slowing supply chains and creating uncertainty for large corporations.

The main question is: will Trump's economic policy really bring the promised growth, or will the global economy enter a new phase of instability? The answer to this question will depend on further decisions by the White House and the reaction of global markets.