Cryptocurrencies seem inaccessible to many people for several reasons. Firstly, they are something new and unexplored; secondly, the mechanisms of their issuance and circulation also raise many questions; and thirdly, there is no regulatory body responsible for overseeing and being accountable for the transactions conducted.

However, in reality, it's not as daunting as it seems, and it is indeed possible to earn income from digital currencies. Moreover, this can be done without having a large amount of initial capital. There are ways to make money with minimal financial and other resource investments. This article will discuss such methods.

To demystify cryptocurrencies and learn more about their key features, varieties, advantages, and disadvantages, we recommend reading the article "Cryptocurrency for beginners."

How to earn on cryptocurrency with minimal investment

The cryptocurrency market is attracting an increasing number of people. Many have heard about various income opportunities that are not available with other, more traditional assets.

When newcomers hear or read about someone making millions in crypto, they naturally want to try to earn as well. However, not everyone succeeds, as this is not a casino or lottery where luck alone might suffice. Here, a calculated approach is necessary.

Just like with any other instrument, when dealing with digital currencies, it's crucial to correctly determine the moments to buy and sell. This requires the ability to analyze the market and understand its direction, identify trends, and predict the further movement of values.

Sounds more complicated than winning the lottery, doesn't it? However, aside from trading and making transactions with cryptocurrency, there are many other ways to earn income. Some of these do not require significant financial investment at the start.

The fact is that the cryptocurrency market attracts people from various backgrounds with different levels of knowledge and experience. Newcomers are trying their hand at financial markets for the first time, and some have traded on the stock or currency market but decided to try something new.

Some users buy digital coins to diversify their portfolios, while others specialize in cryptocurrencies as the most promising instrument.

Those users who come to crypto exchanges from other markets often already have some experience and resources for investing and conducting larger operations. However, some newcomers want to earn and are looking for different options. This article will examine some of these options.

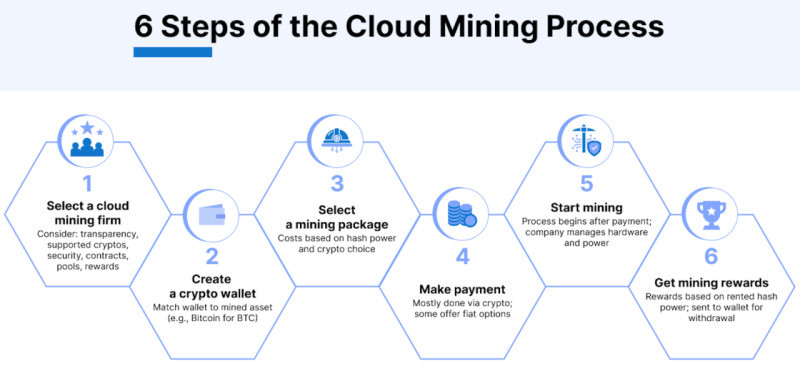

Cloud mining

Mining is one of the most well-known methods of earning from digital currencies. However, this activity comes at a high cost, so in the context of discussing how to earn from cryptocurrency with minimal investments, we will consider its "lighter" variant – cloud mining.

In the case of traditional mining, it is necessary to purchase expensive equipment and find a location for its placement. In addition to its high cost, such equipment also requires a significant amount of electricity, for which the miner will also have to pay, and technical knowledge.

Cloud mining differs in that users do not have to bear all the aforementioned costs. Instead, they pay a fixed amount (a fee) for the remote use of someone else's equipment.

Thus, miners join a chosen mining farm that owns all the necessary technical equipment, and in return, they receive a portion of the rewards for new blocks created.

Advantages of cloud mining:

Lower entry threshold, meaning initial investments are smaller;

No need for technical knowledge and equipment;

Opportunities for scaling.

When digital currencies first appeared, mining was relatively simple and could be done using a regular PC. However, the process has become much more complex, with increased competition in the field, making access more difficult for private miners.

Moreover, this sphere has quite a few scammers – companies that supposedly offer cloud mining but actually just want to take other users' funds. They offer unrealistic, inflated returns, operating mainly on the principle of financial pyramids.

Trading

We've included cryptocurrency trading in this list for a reason, as speculative transactions can start with as little as $1. Naturally, working with such an amount in the Bitcoin market would be somewhat challenging due to its high cost, but it's possible to trade other digital currencies that are popular but not as expensive.

This method of income has many advantages. For example, if a person has already traded other assets, there is nothing fundamentally new they need to do.

Additionally, due to strong price fluctuations even within a single day, digital currencies are well-suited for short-term transactions. Nonetheless, there are nuances to consider.

One such feature is the "youth" of all cryptocurrencies, many of which have been around for no more than 10 years, and some only 3-5 years. For this reason, it's impossible to conduct an objective technical analysis in its classical understanding based on historical data, as it simply does not exist.

Another important feature is decentralization, which means the absence of influence from national banks or other governmental structures on digital currencies and their rate. Their value is regulated only by the supply and demand balance.

However, this also complicates the ability to predict the direction in which the value of any given coin will move. News and rumors, for example, about the purchase or sale of a large batch of a certain currency, also significantly impact crypto.

In 2018, there was a crash in the cryptocurrency market, where by the end of the year, the value of all the most significant and well-known coins dropped by 70-90%. After this situation, many were disillusioned with digital currencies and predicted their disappearance. For instance, the value of Bitcoin fell from almost $20,000 to $3,200.

Nevertheless, we can see that the market has gradually recovered, and now the value of Bitcoin is over $40,000. Many users now likely regret not stocking up on Bitcoins in 2018. This is the essence of trading: being able to analyze and correctly choose entry points into a position.

Arbitrage

Thanks to the high volatility of cryptocurrencies, another option has emerged for earning on cryptocurrency with minimal investments. This method is called arbitrage, and its essence is similar to trading: buy low and sell high.

However, there is one significant difference: the purchase and sale take place on different platforms. The price of the same asset can vary across different platforms, and it's this difference that allows a trader to make a profit.

Such differences can arise for various reasons: for example, due to insufficient liquidity on a platform or too much activity by a particular player in the market. Also, one of the common reasons is the decentralization of cryptocurrency exchanges and differences in demand for various coins across different platforms.

Additional opportunities for arbitrage that digital currencies provide include the 24/7 operation of trading platforms and a wide variety of cryptocurrency pairs.

Compared to, for example, the stock market, cryptocurrency arbitrage is more attractive because digital currency rates change significantly faster and have a higher profit potential. Additionally, it requires quick reaction speeds and monitoring rates on several platforms simultaneously. Therefore, users often resort to using special bots that track quote changes and signals.

For beginners, it is better to choose the most popular and well-known digital coins and trade them in pairs with fiat currencies. That means buying crypto for fiat money on one platform and then making the reverse transaction on another at a more favorable rate.

Creating or buying NFTs

There's an interesting way for creative individuals to earn income from cryptocurrencies – creating NFTs. These are special non-fungible tokens that exist in a single instance.

Examples include various works of art: books, paintings, songs, etc., game characters, and other objects. Additionally, any real object can be made into an NFT by obtaining a digital certificate of ownership for it.

The value of such a work is determined not so much by the market but by the author and their actions. Thus, NFTs created by well-known authors inherently have a higher value. The value of some digital paintings can reach several thousand dollars.

Naturally, it is impossible to acquire such expensive works with minimal investments. However, there are other opportunities for newcomers to earn in this sphere, as they do not require special skills for deep market analysis.

Firstly, one can create an object independently, which of course requires a certain creative potential. For those who possess it, this is an excellent option for earning income, as this sphere is rapidly developing.

Another option is to purchase the works of other authors who have not yet gained wide recognition. Typically, their works might only cost a few US dollars, making them accessible to everyone.

However, it is important to choose wisely which works to buy. In one case, the work of an unknown author may remain unknown and in demand. In another case, the author may become famous, and all their works could instantly soar in price.

Additionally, you can buy game characters and upgrade them yourself. In such a situation, you could purchase a character for a couple of dollars, and after upgrading them to the next level, you could sell them for $20,000.

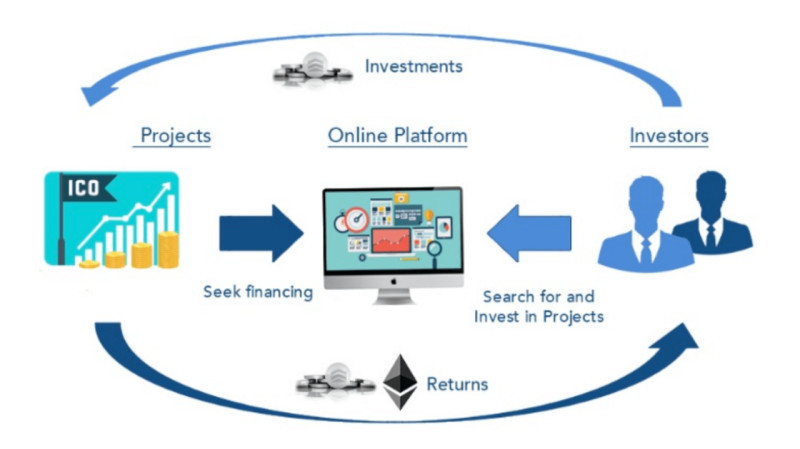

Investments in startups

Similar to the previous method of earning income, there is another way to make money from cryptocurrency with minimal investments: investing in cryptocurrency startups. The principle here is the same as with NFT artworks: betting that the project you invest in will "take off," allowing you to earn many times more than the initial investment.

When someone decides to release a new type of digital currency, they need funds for it. Often, they need to attract additional financing because their funds are insufficient. In such situations, they announce an Initial Coin Offering (ICO), similar to an Initial Public Offering (IPO) on the stock exchange, where shares of a new company are listed.

During an ICO, the terms are announced: the start date of sales, the process of acquiring coins, and their cost. The price can be fixed or variable, and the company may set a certain number of tokens that can be purchased.

Typically, new coins are bought with other cryptocurrencies or fiat money, which is transferred to the specified wallet address. Here, everything depends on the potential investor's available capital and how many coins they can buy.

The most important aspect of this method is making the right choice of asset to invest in. Often, new projects start with small amounts, and their tokens are not worth much, but they can later increase in value several times.

A prime example is Bitcoin, which was worth just a few cents when it first hit the market and now has a value exceeding $40,000. However, not all projects turn out to be successful, and statistically, most new coins do not become successful, with many disappearing from the scene shortly after their release.

Copy trading

Many of the previously described earning options are mostly suitable for novice users. However, there are ways for more experienced users to earn from cryptocurrency with minimal investments as well.

Copy trading is one of these universal options. It can suit both novices and veterans, though their roles will differ. For beginners, this service is attractive because it allows them to copy the trades of other traders without having any experience or trading skills.

This automated system enables the trades of one trader to be automatically replicated in another account. There is no specific threshold for entry; one can start trading with any amount.

All a novice trader needs to do is select user accounts that seem most attractive in terms of profitability and subscribe to them. After that, all the selected trader's transactions are copied to the subscriber's account.

This can be considered a form of passive income. Additionally, this trading method allows traders to learn by watching how experienced players operate, adopting their strategies, learning to conduct analysis, and finding successful entry points.

On the other hand, for an experienced user, this is a way to earn a steady additional income without doing anything special. The trader simply continues trading and making transactions but receives an additional reward for it.

Therefore, no additional investments are required to earn this income, only their skills and experience in successful trading. An experienced trader posts an announcement with all the subscription terms on the trading platform, other users copy their trades, and they earn a commission for it.

Educational courses

Another good earning option for experienced users, which requires practically no investment, is teaching. When someone has achieved a lot, possessing a wealth of knowledge and experience, they can share this with others.

The internet is full of educational information about digital currencies, including articles, online courses, webinars, books, and much more, often labeled as "top" or "best."

However, an author's expertise is determined by their achievements. It's possible to master the theory without ever practicing what you teach.

This approach does not work with cryptocurrency – without practical skills, one cannot claim to be an expert in this field. Only those who have independently made a significant amount of money from crypto can consider themselves experts.

Digital currencies are an asset with their specifics, differing from other trading instruments. Hence, the specifics of working with this instrument differ from all other assets. An important skill for a teacher is the ability to explain complex subjects in simple terms.

To stand out among other teachers and experts, the author needs to develop something unique that immediately attracts users' attention. They should come up with an interesting teaching method and include practical lessons that help novices "dive into" the cryptocurrency environment.

The only investment required is advertising. Once the course or lecture series is ready, it is necessary to attract users. This can be done through various channels, depending on the author's target audience.

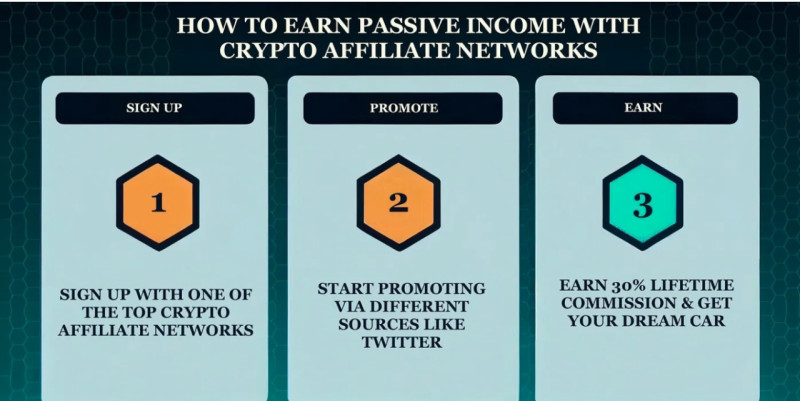

Affiliate programs

Affiliate programs can be a decent earning option, especially if you have your website, for example, with educational courses. This can be an excellent additional income, besides earning from teaching.

If you do not have your website, any other "communication channels" will do: social media pages, messenger chats, blogs, and other sources. Here, the channel's importance is less significant than the personality of the one posting the link, specifically how much trust they have from their followers.

How does it work? A user registers in an affiliate program on any cryptocurrency exchange or exchange service. They then receive a personal referral link, which they can and should share to attract new clients to the platform.

When other users follow the link and register on the exchange, the affiliate receives a reward. Additionally, the affiliate earns from every transaction made by clients they've brought in.

Another plus is that the reward is typically paid out in cryptocurrency immediately. This allows one to get their first coins and gradually build their cryptocurrency portfolio with practically no investment.

The greater a person's authority and popularity, the faster they can grow their network of referred clients. This can lead to a decent income. However, if someone has a small audience, this method of earning might not be suitable for them.

Conclusion

In this article, we have introduced the main ways to earn from cryptocurrency with minimal investments. As can be seen from our article, there are numerous options for users of different income levels, as well as knowledge and experience.

For instance, there are several ways to earn from trading cryptocurrency: directly engaging in speculative transactions, arbitrage, and copy trading. Arbitrage differs from trading in that the buying and selling transactions of coins are carried out on different platforms.

Copy trading is unique in its universality: for novices, it serves as a way to earn passive income while simultaneously gaining trading skills. For experienced users, it's a method to earn additional profit without extra expenses: they continue to trade but also receive a commission for having their trades copied.

Another excellent method for experienced, successful users is teaching. When a sufficient amount of knowledge has been accumulated, it can be shared by creating a course or writing a book. This does not require huge resource expenditures but can provide a steady income from students.

For creative individuals, creating or purchasing NFTs is suitable. These are unique tokens that exist in a single instance. If their creator becomes famous, their value can skyrocket instantly.

Another interesting way to earn is through cloud mining, which does not require the purchase and installation of expensive equipment. One can simply rent equipment from specialized companies and engage in mining remotely.

You may also like:

What is Cryptocurrency Used for

What Cryptocurrency is Backed by Gold

When was the First Cryptocurrency Created

Back to articles

Back to articles