व्यापारी कैलक्यूलेटर

Take advantage of a trader’s calculator by InstaForex to estimate the following parameters:

- a margin size per trade

- a pip value

All you need to do is enter a few basic data such as a particular financial instrument, the currency of your account, a trade size in lots, and leverage. Hence, you can reckon a trading plan for 300+ trading instruments that will save a lot of your time.

If you want to use a trader’s calculator by InstaForex, you do not have to register in advance or install any software. Parameters entered are processed online. The company’s powerful servers ensure flawless connection so that a trader can instantly figure out the best market entry point and other variants of a trade.

Important!

A pip value for currency pairs is calculated based on the current exchange rate of a particular pair.

Please take notice that 1 lot with InstaForex equals 10,000 units of a base currency.

Here are formulas for calculating a pip value of currency pairs and CFDs.

Calculation of a pip value:

1. XXX/USD

Pip value = 1 * (number of lots)

2. USD/XXX

Pip value = 1 / (USD/XXX) * (number of lots)

3. AAA/BBB

A pip value = (AAA/USD) / (AAA/BBB) * (number of lots)

Calculation of a pip value for CFDs:

Pip value = number of contracts * contract size * tick value

Why does InstaForex suggest a lot size of 10,000 instead of a standard lot size of 100,000 units of a base currency?

InstaForex offers its clients an opportunity to trade Forex applying three lot sizes in parallel within the same trading account. Three lot sizes are designated as Micro Forex, Mini Forex, and Standard Forex. To put this technology into practice, the company introduced an unconventional lot size of 10,000 units. For example, if a trade size equals 0.01 lot, this makes a pip value as low as $0.01. In other words, this is an absolute minimum that allows holders of accounts with $5,000 - $10,000 to manage their risks with utmost efficiency. Besides, a lot size of 10,000 units simplifies calculations of a pip value when opening positions.

Look at the following trade parameters:

- Trade size is 0.01 InstaForex lot = pip value is $0.01

- Trade size is 0.1 InstaForex lot = pip value is $0.1

- Trade size is 1 InstaForex lot = pip value is $1

- Trade size is 10 InstaForex lots = pip value is $10

- Trade size is 100 InstaForex lots = pip value is $100

- Trade size is 1,000 InstaForex lots = pip value is $1,000

A pip value is specified in a base currency of a currency pair’s quote.

InstaForex lots ensure convenient calculations and the possibility of trading three lot sizes inside the common trading account. This is a major advantage of trading conditions with InstaForex.

See Also

-

एआई पर दांव: पांच उच्च संभावित स्टॉक्स जिन्हें ध्यान में रखना चाहिए

एआई पर दांव: पांच उच्च संभावित स्टॉक्स जिन्हें ध्यान में रखना चाहिए -

हॉलीवुड के सबसे ज्यादा कमाई करने वाले अभिनेता 2024

हॉलीवुड के सबसे ज्यादा कमाई करने वाले अभिनेता 2024 -

पांच सबसे लुभावने परिदृश्य

पांच सबसे लुभावने परिदृश्य -

यूरोप के सर्वश्रेष्ठ क्रिसमस मार्केट्स

यूरोप के सर्वश्रेष्ठ क्रिसमस मार्केट्स -

दुनिया भर में शीर्ष 5 सबसे अधिक आबादी वाले महानगर

दुनिया भर में शीर्ष 5 सबसे अधिक आबादी वाले महानगर -

दुनिया के दस सबसे धनी सम्राट

दुनिया के दस सबसे धनी सम्राट -

पैदल यात्रा के लिए सात सबसे खूबसूरत शहर

पैदल यात्रा के लिए सात सबसे खूबसूरत शहर

- 2025-03-31 03:50:42No Change in CFTC Silver Speculative Net Positions Amid Market Uncertaintyत्वरित शो2025-03-31 03:50:42Stability in the Market: CFTC Reports Unchanged S&P 500 Speculative Net Positionsत्वरित शो2025-03-31 03:50:42Speculative Net Short Positions in U.S. Natural Gas Widen Further to -131.9Kत्वरित शो2025-03-31 03:50:42Speculative Net Positions in Nasdaq 100 Remain Steady at 23.0K, Says CFTCत्वरित शो2025-03-31 03:50:42Crude Oil Speculative Net Positions Surge as Traders Bet on Rising Pricesत्वरित शो2025-03-31 03:50:42CFTC Reports Significant Decline in Corn Speculative Net Positionsत्वरित शो2025-03-31 03:50:42Stability in Copper Market as CFTC Speculative Net Positions Hold Steadyत्वरित शो2025-03-31 03:50:42U.S. CFTC Aluminium Speculative Net Positions Hold Steady at 1.9Kत्वरित शो2025-03-31 03:50:42Euro Zone's CFTC EUR Speculative Net Positions Steady at 59.4Kत्वरित शो2025-03-31 03:50:42GBP Speculative Net Positions Hold Steady Amid Market Stabilityत्वरित शो

- 2025-03-31 03:50:42China's Composite PMI Sees Slight Uptick in Marchत्वरित शो2025-03-31 03:50:42China's Non-Manufacturing PMI Sees Slight Uptick in March 2025त्वरित शो2025-03-31 03:50:42China's Manufacturing PMI Edges Slightly Upward in Marchत्वरित शो2025-03-31 03:50:42Japanese Shares Plunge Ahead of Trump Tariffsत्वरित शो2025-03-31 03:50:42Japan Retail Sales Rise the Least in 4 Monthsत्वरित शो2025-03-31 03:50:42Australian Shares Slide on Tariff Concernsत्वरित शो2025-03-31 03:50:42New Zealand Business Confidence Dips Slightly in Marchत्वरित शो2025-03-31 03:50:42Australia's Housing Credit Growth Stalls at 0.4% for Second Consecutive Monthत्वरित शो2025-03-31 03:50:42Australia's Private Sector Credit Holds Steady in February, No Month-Over-Month Changeत्वरित शो2025-03-31 03:50:42Japan Industrial Production Rises More Than Expectedत्वरित शो

- 2025-03-31 03:50:42NBNZ Own Activity in New Zealand Surges in March: A Positive Economic Indicatorत्वरित शो2025-03-31 03:50:42New Zealand's ANZ Business Confidence Slightly Dips in Marchत्वरित शो2025-03-31 03:50:42Japan's Retail Sales Stagnation: No Growth in February 2025 as Figures Plateau at 0.5%त्वरित शो2025-03-31 03:50:42Japan's Retail Sales Growth Halves in February Amid Economic Uncertaintyत्वरित शो2025-03-31 03:50:42Japan's Industrial Production Makes Marginal Rebound in April 2024त्वरित शो2025-03-31 03:50:42Japanese Industrial Production Sees Sharp Decline in Marchत्वरित शो2025-03-31 03:50:42Japan's Retail Sales Growth Slows to 1.4% in February, Down from 4.4% in Januaryत्वरित शो2025-03-31 03:50:42Japan's Industrial Production Surges by 2.5% in Februaryत्वरित शो2025-03-31 03:50:42US Futures Decline Ahead of ‘Liberation Day’त्वरित शो2025-03-31 03:50:42South Korea Retail Sales Rise in Februaryत्वरित शो

- 2025-03-31 03:50:42South Korea Industrial Production Rebounds in Februaryत्वरित शो2025-03-31 03:50:42South Korea's Industrial Production Rebounds in February, Easing Economic Concernsत्वरित शो2025-03-31 03:50:42South Korean Service Sector Rebounds with Positive February Outputत्वरित शो2025-03-31 03:50:42South Korea Retail Sales Rebound in February: Surges to 1.5% Month-over-Monthत्वरित शो2025-03-31 03:50:42South Korea's Industrial Production Rebounds Unexpectedly with 7.0% Growth in Februaryत्वरित शो2025-03-31 03:50:42New Zealand Stocks Head for 3rd Straight Monthly Lossesत्वरित शो2025-03-31 03:50:42Mexico's Fiscal Balance Worsens Significantly in Februaryत्वरित शो2025-03-31 03:50:42US Stocks Tumble on Inflation Concerns and Trade Disruptionsत्वरित शो2025-03-31 03:50:42TSX Retreats Amid Trade Tensions and Economic Headwindsत्वरित शो2025-03-31 03:50:42Crude Oil Eases, But Posts 3rd Weekly Gainत्वरित शो

- 2025-03-31 03:50:42Stagnation in CFTC Gold Speculative Net Positions: No Change Observed in Latest Data Updateत्वरित शो2025-03-31 03:50:42Semi-Stable Shores: New Zealand Dollar Speculative Net Positions Remain Unchangedत्वरित शो2025-03-31 03:50:42Stability in CFTC JPY Speculative Net Positions Marks a Steady Signal Amid Economic Volatilityत्वरित शो2025-03-31 03:50:42CFTC BRL Speculative Net Positions Hold Steady at 40.7K as of March 28, 2025त्वरित शो2025-03-31 03:50:42Australian Dollar Positions Hold Steady Amid Market Speculation: CFTC Data Revealsत्वरित शो2025-03-31 03:50:42Swiss CHF Speculative Net Positions Hold Steady at -34.4K, CFTC Reportsत्वरित शो2025-03-31 03:50:42Stability Mark: CFTC MXN Speculative Net Positions Hold Steady at 56.0Kत्वरित शो2025-03-31 03:50:42Canadian Dollar Speculation Remains Stable as CFTC Reports Unchanged Net Positionsत्वरित शो2025-03-31 03:50:42Sharp Decline in Wheat Speculative Positions Reflects Market Uncertaintyत्वरित शो2025-03-31 03:50:42CFTC Reports Significant Drop in Soybean Speculative Net Positions as Market Dynamics Shiftत्वरित शो

- 2025-03-31 03:50:42No Change in CFTC Silver Speculative Net Positions Amid Market Uncertaintyत्वरित शो2025-03-31 03:50:42Stability in the Market: CFTC Reports Unchanged S&P 500 Speculative Net Positionsत्वरित शो2025-03-31 03:50:42Speculative Net Short Positions in U.S. Natural Gas Widen Further to -131.9Kत्वरित शो2025-03-31 03:50:42Speculative Net Positions in Nasdaq 100 Remain Steady at 23.0K, Says CFTCत्वरित शो2025-03-31 03:50:42Crude Oil Speculative Net Positions Surge as Traders Bet on Rising Pricesत्वरित शो2025-03-31 03:50:42CFTC Reports Significant Decline in Corn Speculative Net Positionsत्वरित शो2025-03-31 03:50:42Stability in Copper Market as CFTC Speculative Net Positions Hold Steadyत्वरित शो2025-03-31 03:50:42U.S. CFTC Aluminium Speculative Net Positions Hold Steady at 1.9Kत्वरित शो2025-03-31 03:50:42Euro Zone's CFTC EUR Speculative Net Positions Steady at 59.4Kत्वरित शो2025-03-31 03:50:42GBP Speculative Net Positions Hold Steady Amid Market Stabilityत्वरित शो

- 2025-03-31 03:50:42China's Composite PMI Sees Slight Uptick in Marchत्वरित शो2025-03-31 03:50:42China's Non-Manufacturing PMI Sees Slight Uptick in March 2025त्वरित शो2025-03-31 03:50:42China's Manufacturing PMI Edges Slightly Upward in Marchत्वरित शो2025-03-31 03:50:42Japanese Shares Plunge Ahead of Trump Tariffsत्वरित शो2025-03-31 03:50:42Japan Retail Sales Rise the Least in 4 Monthsत्वरित शो2025-03-31 03:50:42Australian Shares Slide on Tariff Concernsत्वरित शो2025-03-31 03:50:42New Zealand Business Confidence Dips Slightly in Marchत्वरित शो2025-03-31 03:50:42Australia's Housing Credit Growth Stalls at 0.4% for Second Consecutive Monthत्वरित शो2025-03-31 03:50:42Australia's Private Sector Credit Holds Steady in February, No Month-Over-Month Changeत्वरित शो2025-03-31 03:50:42Japan Industrial Production Rises More Than Expectedत्वरित शो

- Fundamental analysis

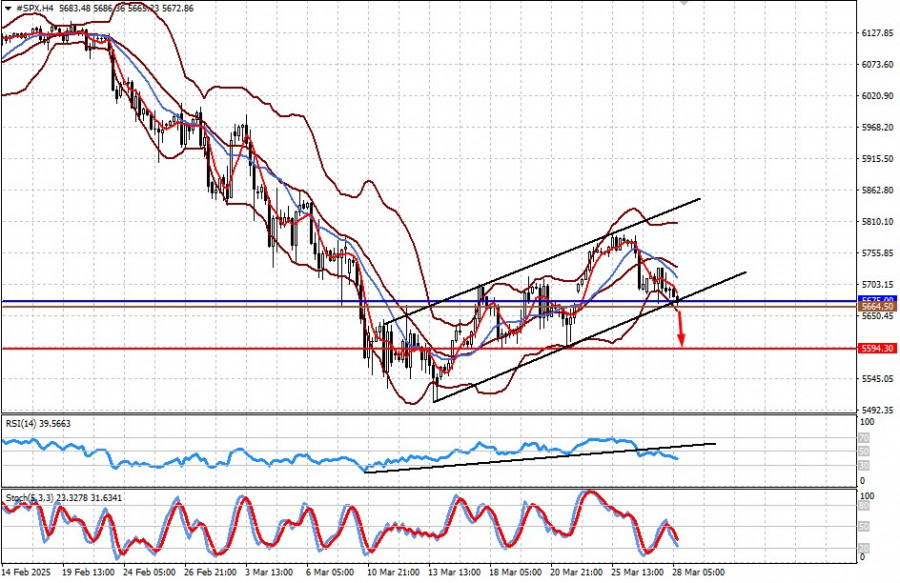

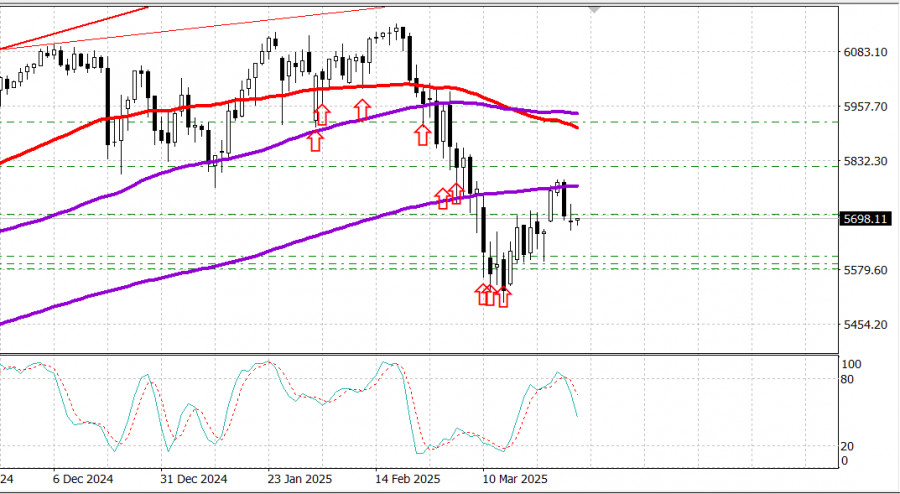

डी. ट्रम्प द्वारा टैरिफ घोषणा से पहले बाजार दोराहे पर (#SPX और #NDX फ्यूचर्स पर CFD अनुबंधों में संभावित गिरावट)

बाजार अब पूरी तरह से आश्वस्त हैं कि अमेरिकी राष्ट्रपति घरेलू बाजार को बंद करने और ऐसा करने में घरेलू निर्माताओं को प्रोत्साहित करने के उद्देश्य से गंभीर सीमा शुल्कलेखक: Pati Gani

19:32 2025-03-28 UTC+2

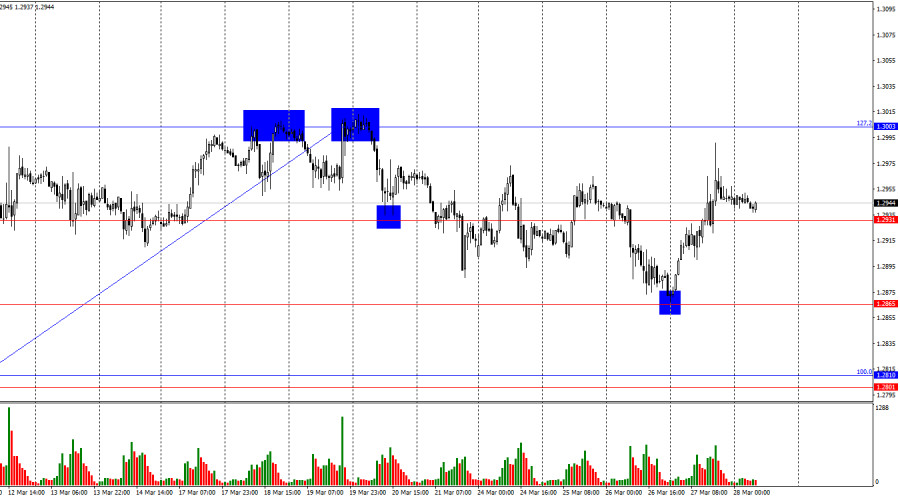

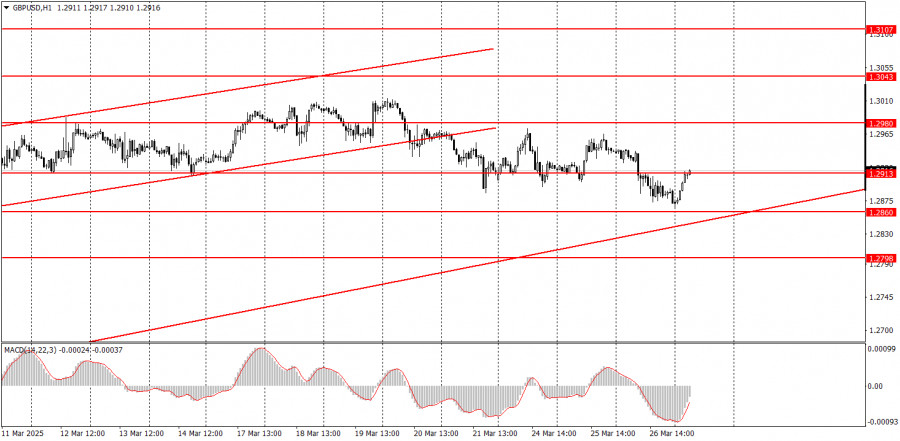

44

प्रति घंटा चार्ट पर, GBP/USD जोड़ी ने गुरुवार को 1.2865 के स्तर से वापसी की, पाउंड के पक्ष में उलटफेर किया, और 1.2931 के स्तर से ऊपर उठ गई, जिसकालेखक: Samir Klishi

19:24 2025-03-28 UTC+2

38

Stock Marketsअमेरिकी शेयर बाजार: ट्रंप के टैरिफ ने तेजी को रोका, इसलिए बेंचमार्क शेयर सूचकांक मजबूत हो रहे हैं। आज निवेशकों की नजर पीसीई डेटा पर

S&P500 28 मार्च को बाज़ार अपडेट अमेरिकी शेयर बाज़ार: ट्रम्प के टैरिफ़ ने तेज़ी को रोका, इसलिए बेंचमार्क शेयर सूचकांकों में मजबूती आई। आज निवेशकों की नज़र PCE डेटालेखक: Jozef Kovach

19:23 2025-03-28 UTC+2

37

- यदि आपको पहली बार समझ नहीं आती है, तो दूसरी बार समझ में आ जाएगी। यू.एस. और विदेशी ऑटोमेकर शेयरों के नेतृत्व में एसएंडपी 500 की बिक्री 25% टैरिफ लगाए

लेखक: Marek Petkovich

19:18 2025-03-28 UTC+2

38

हालाँकि Pectra टेस्ट अपग्रेड का सफलतापूर्वक Hoodi टेस्टनेट पर रोलआउट हुआ—जो संभवतः Ethereum मेन नेट पर अंतिम अपडेट से पहले का अंतिम चरण है और जिसका उद्देश्य स्केलेबिलिटी, स्टेकिंगलेखक: Jakub Novak

19:10 2025-03-28 UTC+2

41

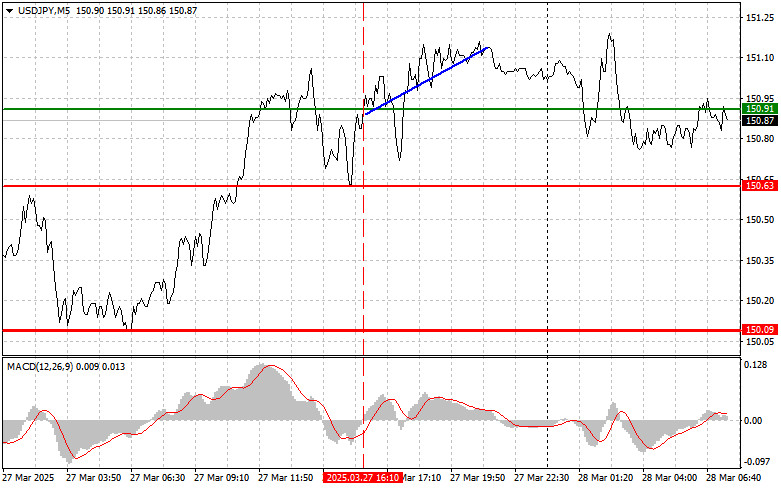

ForecastUSD/JPY: 28 मार्च को शुरुआती ट्रेडर्स के लिए सरल ट्रेडिंग टिप्स। कल के फॉरेक्स ट्रेड्स की समीक्षा

150.91 पर मूल्य परीक्षण तब हुआ जब MACD संकेतक ने शून्य चिह्न से ऊपर की ओर बढ़ना शुरू किया था, जो डॉलर खरीदने के लिए एक वैध प्रवेश बिंदु कीलेखक: Jakub Novak

19:09 2025-03-28 UTC+2

36

- Forecast

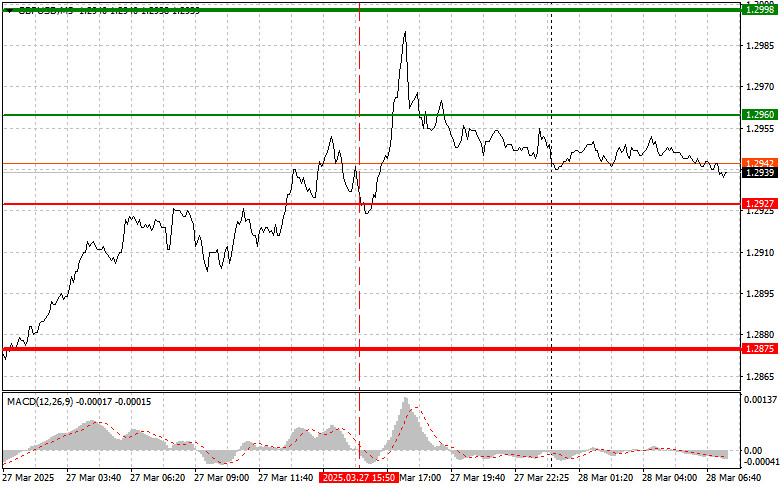

GBP/USD: 28 मार्च को शुरुआती ट्रेडर्स के लिए सरल ट्रेडिंग टिप्स। कल के फॉरेक्स ट्रेड्स की समीक्षा

1.2927 पर मूल्य परीक्षण तब हुआ जब MACD संकेतक शून्य चिह्न से नीचे की ओर बढ़ना शुरू हुआ, जो पाउंड को बेचने के लिए एक वैध प्रवेश बिंदु की पुष्टिलेखक: Jakub Novak

19:05 2025-03-28 UTC+2

35

ट्रम्प के नवीनतम टैरिफ़ झटके के बाद ऑटो स्टॉक में गिरावट ब्रोकरेज डाउनग्रेड के बाद एडवांस्ड माइक्रो डिवाइस में गिरावट साप्ताहिक बेरोज़गारी दावों की कुल संख्या 224,000 कनाडाई डॉलर, मैक्सिकनलेखक: Thomas Frank

19:03 2025-03-28 UTC+2

35

Trading plan27 मार्च को GBP/USD जोड़ी में कैसे ट्रेड करें? शुरुआती लोगों के लिए सरल सुझाव और ट्रेड विश्लेषण

बुधवार के ट्रेडों का विश्लेषण GBP/USD का 1H चार्ट बुधवार को, GBP/USD जोड़ी ने नीचे की ओर गति दिखाई जो अंततः व्यापक आर्थिक पृष्ठभूमि के साथ संरेखित हुई। दिन केलेखक: Paolo Greco

19:24 2025-03-27 UTC+2

37