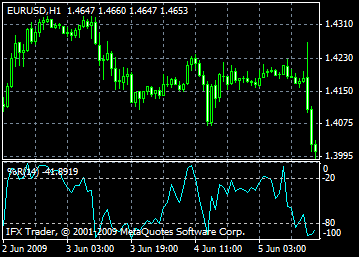

Technical Indicator Williams` Percent Range (%R) is a dynamic indicator, which determines overbought or oversold condition of the market. Williams` Percent Range is and Stochastic Oscillator are very similar. The only difference is that the first one has an upside down scale and the Stochastic Oscillator has internal smoothing.

Indicator values ranging between 80 and 100% show that the market is oversold. Indicator values ranging between 0 and 20% show that the market is overbought. When the indicator is in the upside down scale, its values usually are assigned a minus symbol (for example -30%). During analysis one may ignore the minus symbol.

All overbought/oversold indicators obey one rule: act according to the signal when prices turn happens. For example, if an overbought/oversold indicator shows an overbought condition, it is better to wait until the prices turn down before executing a sell deal.

Williams Percent Range indicator can foreseen prices reversals. The indicator almost always forms a peak and turns in backward direction a few days before the price reaches its peak and goes down. Thus, Williams Percent Range forms a trough and turns up a few days before the price goes up.

Calculation

TBelow is the formula of the %R indicator calculation, which is very similar to the Stochastic Oscillator formula: %R = (HIGH(i-n)-CLOSE)/(HIGH(i-n)-LOW(i-n))*100

Where:

CLOSE - is today`s closing price;

HIGH(i-n) - is the highest high over a number (n) of previous periods;

LOW(i-n) - is the lowest low over a number (n) of previous periods.