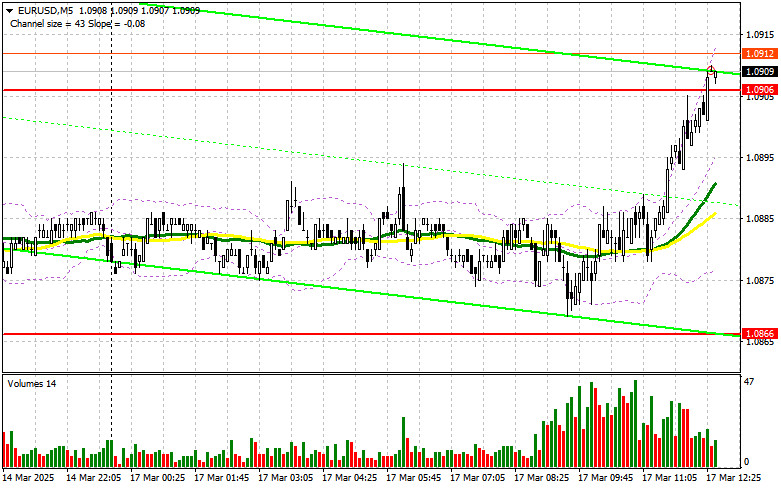

In my morning forecast, I highlighted the 1.0866 level as a key point for making entry decisions. Let's look at the 5-minute chart to analyze what happened. A decline did occur, but the price fell just short of testing the level by a couple of points, leaving me without a suitable entry point. The technical outlook for the second half of the day remains unchanged.

To Open Long Positions on EUR/USD:

The absence of economic data from the Eurozone allowed euro buyers to show some activity, but as seen on the chart, the pair failed to generate strong upward momentum. However, the bullish outlook still appears more promising than a corrective decline.

Key upcoming reports include U.S. retail sales, as well as the Empire Manufacturing Index and the NAHB Housing Market Index. If retail sales rise, demand for the dollar will return, as stronger spending could increase inflationary pressure. Given the lackluster market conditions, I prefer to buy the pair on a decline.

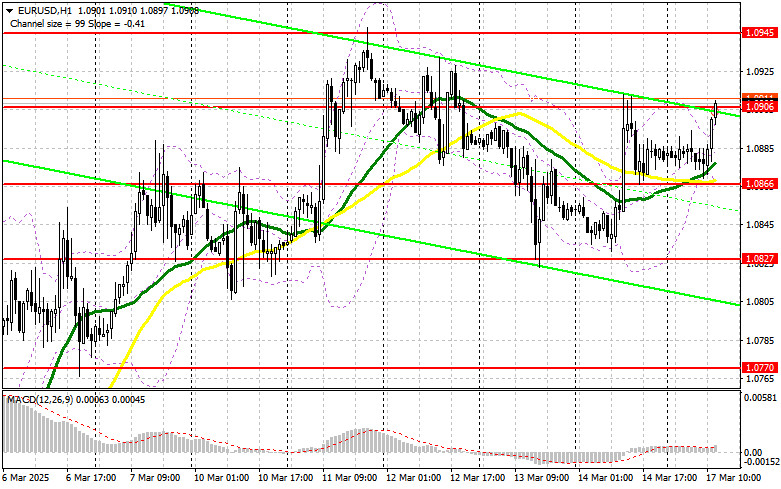

The primary goal for bulls in the second half of the day is to defend the 1.0866 support level. A false breakout at this level would be a buy signal, reinforcing the bullish market structure with a target of 1.0906. A break and a subsequent retest of this level would confirm a valid buy entry, leading to 1.0945, the upper boundary of the sideways channel. The final target would be the 1.0997 high, where I will lock in profits.

If EUR/USD declines and buyers fail to show activity at 1.0866, the pair will likely remain within the range, possibly leading to a minor correction. Sellers could push the pair down to 1.0827. Only after a false breakout at this level would I consider buying the euro. If the pair drops further, I will buy on a rebound from 1.0770, aiming for a 30-35 point intraday correction.

To Open Short Positions on EUR/USD:

Sellers have been inactive, and their return to the market depends on strong U.S. retail sales data. A false breakout at 1.0906, combined with positive economic reports, would provide an entry point for short positions, aiming for a correction toward 1.0866, where the 50-day and 30-day moving averages (favoring bulls) are located.

A break and consolidation below this range would offer an additional selling opportunity, targeting 1.0827. The final bearish target is 1.0770, where I will take profits.

If EUR/USD rises in the second half of the day and bears fail to act at 1.0906, buyers may push the pair significantly higher. In that case, I will delay short positions until the next resistance level at 1.0945, where I will sell only after an unsuccessful breakout attempt. I will sell immediately on a rebound from 1.0997, targeting a 30-35 point downward correction.

COT (Commitments of Traders) Report – March 4:

The latest COT report showed a rise in long positions and a significant reduction in short positions, indicating that more traders are willing to buy the euro. Germany's new fiscal stimulus measures have boosted demand for the euro, leading to its strengthening against the U.S. dollar.

The ECB's cautious stance on rate cuts has also supported EUR/USD demand, as reflected in the COT report. The small advantage held by euro sellers is no longer as significant, but buying at current highs still requires caution.

According to the COT data, non-commercial long positions increased by 2,524 to 185,223, while short positions dropped by 12,795 to 195,329. As a result, the gap between long and short positions widened by 3,471.

Indicator Signals:

Moving Averages: Trading is currently taking place near the 30-day and 50-day moving averages, indicating market uncertainty.

Bollinger Bands: If the price declines, the lower Bollinger Band near 1.0866 will act as support.

Indicator Descriptions:

- Moving Average (MA) – Smooths volatility and noise to define the current trend.

- 50-period MA (yellow line)

- 30-period MA (green line)

- MACD (Moving Average Convergence/Divergence)

- Fast EMA – 12-period

- Slow EMA – 26-period

- SMA – 9-period

- Bollinger Bands – Measures volatility. 20-period setting used.

- Non-commercial traders – Speculators such as individual traders, hedge funds, and institutions using the futures market for speculation.

- Non-commercial long positions – The total number of long contracts held by non-commercial traders.

- Non-commercial short positions – The total number of short contracts held by non-commercial traders.

- Net non-commercial position – The difference between short and long positions among non-commercial traders.