交易员计算器

Take advantage of a trader’s calculator by InstaForex to estimate the following parameters:

- a margin size per trade

- a pip value

All you need to do is enter a few basic data such as a particular financial instrument, the currency of your account, a trade size in lots, and leverage. Hence, you can reckon a trading plan for 300+ trading instruments that will save a lot of your time.

If you want to use a trader’s calculator by InstaForex, you do not have to register in advance or install any software. Parameters entered are processed online. The company’s powerful servers ensure flawless connection so that a trader can instantly figure out the best market entry point and other variants of a trade.

Important!

A pip value for currency pairs is calculated based on the current exchange rate of a particular pair.

Please take notice that 1 lot with InstaForex equals 10,000 units of a base currency.

Here are formulas for calculating a pip value of currency pairs and CFDs.

Calculation of a pip value:

1. XXX/USD

Pip value = 1 * (number of lots)

2. USD/XXX

Pip value = 1 / (USD/XXX) * (number of lots)

3. AAA/BBB

A pip value = (AAA/USD) / (AAA/BBB) * (number of lots)

Calculation of a pip value for CFDs:

Pip value = number of contracts * contract size * tick value

Why does InstaForex suggest a lot size of 10,000 instead of a standard lot size of 100,000 units of a base currency?

InstaForex offers its clients an opportunity to trade Forex applying three lot sizes in parallel within the same trading account. Three lot sizes are designated as Micro Forex, Mini Forex, and Standard Forex. To put this technology into practice, the company introduced an unconventional lot size of 10,000 units. For example, if a trade size equals 0.01 lot, this makes a pip value as low as $0.01. In other words, this is an absolute minimum that allows holders of accounts with $5,000 - $10,000 to manage their risks with utmost efficiency. Besides, a lot size of 10,000 units simplifies calculations of a pip value when opening positions.

Look at the following trade parameters:

- Trade size is 0.01 InstaForex lot = pip value is $0.01

- Trade size is 0.1 InstaForex lot = pip value is $0.1

- Trade size is 1 InstaForex lot = pip value is $1

- Trade size is 10 InstaForex lots = pip value is $10

- Trade size is 100 InstaForex lots = pip value is $100

- Trade size is 1,000 InstaForex lots = pip value is $1,000

A pip value is specified in a base currency of a currency pair’s quote.

InstaForex lots ensure convenient calculations and the possibility of trading three lot sizes inside the common trading account. This is a major advantage of trading conditions with InstaForex.

See Also

Spring brings luck! Win $8,000 with InstaForex!

International Women's Day is a time for gifts, spring, and new opportunities! As the most vibrant holiday of the year approaches, InstaForex is launching its traditional Chancy Deposit contest! You have a unique chance to win $8,000 and make this holiday truly unforgettable! How to participate? It's simple: Fund your InstaForex trading account Wait for the winner to be announced What to do with your prize money? Anything you want: dream shopping, an unforgettable trip, or new, more profitable investments. The money is in your hands! Hurry, the campaign is time-limited! Top up your account and join the race for $8,000 today. Who knows, this could be your lucky day. Register.

- 2025-03-26 06:08:37US New Home Sales Slightly Below ForecastsQuick show2025-03-26 06:08:37U.S. New Home Sales Climb in February, Reaching 676K as Market Gains MomentumQuick show2025-03-26 06:08:37U.S. New Home Sales Rebound with 1.8% Increase in FebruaryQuick show2025-03-26 06:08:37Slide in U.S. Consumer Confidence: March Figures Signal UneaseQuick show2025-03-26 06:08:37Richmond Services Index Plunges into Negative Territory in MarchQuick show2025-03-26 06:08:37Richmond Manufacturing Shipments Take a Sudden Dip in MarchQuick show2025-03-26 06:08:37Belgium's Business Climate Worsens in March, Reaching New LowsQuick show2025-03-26 06:08:37Richmond Manufacturing Index Plummets to -4 in March, Signaling Potential Economic StrainQuick show2025-03-26 06:08:37NBH Leaves Monetary Policy Unchanged for 6th MonthQuick show2025-03-26 06:08:37TSX Lifted by Commodity ProducersQuick show

- 2025-03-26 06:08:37BoJ May Hike Rates if Food Inflation Spreads: Governor UedaQuick show2025-03-26 06:08:37Copper Surges to Record High on Tariff ConcernsQuick show2025-03-26 06:08:37Australia Unveils Tax Cuts, Extended Bill Relief in 2025 BudgetQuick show2025-03-26 06:08:37New Zealand Dollar Gains for 2nd DayQuick show2025-03-26 06:08:37Japanese Yen Slips as US Tariffs LoomQuick show2025-03-26 06:08:37South Korean Won Edges LowerQuick show2025-03-26 06:08:37Australian Dollar Muted After Inflation DataQuick show2025-03-26 06:08:37Hong Kong Shares Rise SlightlyQuick show2025-03-26 06:08:37China Stocks Edge Higher as Miners Lead GainsQuick show2025-03-26 06:08:37Gold Trades Near Record LevelsQuick show

- 2025-03-26 06:08:37Dollar Lacks Clear DirectionQuick show2025-03-26 06:08:37Sri Lanka Keeps Policy Rate at 8%Quick show2025-03-26 06:08:37Brent Rises on Supply ConcernsQuick show2025-03-26 06:08:37Oil Rises on Supply ConcernsQuick show2025-03-26 06:08:37KOSPI Rebounds on Chips & AutosQuick show2025-03-26 06:08:37Japanese Shares Extend Gains for Second SessionQuick show2025-03-26 06:08:37Australia Monthly CPI at 3-Month LowQuick show2025-03-26 06:08:37Australian Shares Gain on Mining, Bank BoostQuick show2025-03-26 06:08:37Australia's CPI Declines to 2.40% in February, Signaling Economic CoolingQuick show2025-03-26 06:08:37US Futures Steady After Three-Day RallyQuick show

- 2025-03-26 06:08:37Japan's Corporate Services Price Index Sees Slight Dip to 3.0% Year-over-YearQuick show2025-03-26 06:08:37Bullish Momentum Continues in New Zealand EquitiesQuick show2025-03-26 06:08:37S Korea’s Manufacturing Sentiment at 4-Month HighQuick show2025-03-26 06:08:37US Crude Oil Inventories Fall More than ExpectedQuick show2025-03-26 06:08:37South Korea's Manufacturing BSI Index Sees Modest Gain in March 2025Quick show2025-03-26 06:08:37U.S. API Weekly Crude Oil Stocks Fall Sharply to -4.6 MillionQuick show2025-03-26 06:08:37S&P 500, Nasdaq Rise for 3rd DayQuick show2025-03-26 06:08:37Oil Edges Lower Amid Supply Concerns and Economic UncertaintyQuick show2025-03-26 06:08:37Wall Street Wavers as Tariff Concerns LingerQuick show2025-03-26 06:08:37UK Stocks End HigherQuick show

- 2025-03-26 06:08:37DAX Ends on Higher NoteQuick show2025-03-26 06:08:37US 2-Year Note Auction Yields Decrease as Market Adjusts to Economic SignalsQuick show2025-03-26 06:08:37US M2 Money Supply Shows Modest Growth in February 2025Quick show2025-03-26 06:08:37European Stocks Rise on U.S. Tariff News and German Business SentimentQuick show2025-03-26 06:08:37Brazilian Real Strengthens on Tightening OutlookQuick show2025-03-26 06:08:37Belgium Business Confidence Falls to Over 1-Year LowQuick show2025-03-26 06:08:37Dollar Slightly Down as Investors Digest Economic Data and Fed SignalsQuick show2025-03-26 06:08:37Baltic Dry Index Snaps 2-Day RiseQuick show2025-03-26 06:08:37US 5th District Factory Activity Unexpectedly ShrinksQuick show2025-03-26 06:08:37US 5th District Service Sector Activity Contracts in MarchQuick show

- 2025-03-26 06:08:37US New Home Sales Slightly Below ForecastsQuick show2025-03-26 06:08:37U.S. New Home Sales Climb in February, Reaching 676K as Market Gains MomentumQuick show2025-03-26 06:08:37U.S. New Home Sales Rebound with 1.8% Increase in FebruaryQuick show2025-03-26 06:08:37Slide in U.S. Consumer Confidence: March Figures Signal UneaseQuick show2025-03-26 06:08:37Richmond Services Index Plunges into Negative Territory in MarchQuick show2025-03-26 06:08:37Richmond Manufacturing Shipments Take a Sudden Dip in MarchQuick show2025-03-26 06:08:37Belgium's Business Climate Worsens in March, Reaching New LowsQuick show2025-03-26 06:08:37Richmond Manufacturing Index Plummets to -4 in March, Signaling Potential Economic StrainQuick show2025-03-26 06:08:37NBH Leaves Monetary Policy Unchanged for 6th MonthQuick show2025-03-26 06:08:37TSX Lifted by Commodity ProducersQuick show

- 2025-03-26 06:08:37BoJ May Hike Rates if Food Inflation Spreads: Governor UedaQuick show2025-03-26 06:08:37Copper Surges to Record High on Tariff ConcernsQuick show2025-03-26 06:08:37Australia Unveils Tax Cuts, Extended Bill Relief in 2025 BudgetQuick show2025-03-26 06:08:37New Zealand Dollar Gains for 2nd DayQuick show2025-03-26 06:08:37Japanese Yen Slips as US Tariffs LoomQuick show2025-03-26 06:08:37South Korean Won Edges LowerQuick show2025-03-26 06:08:37Australian Dollar Muted After Inflation DataQuick show2025-03-26 06:08:37Hong Kong Shares Rise SlightlyQuick show2025-03-26 06:08:37China Stocks Edge Higher as Miners Lead GainsQuick show2025-03-26 06:08:37Gold Trades Near Record LevelsQuick show

- As the week begins, bearish players are trying to confirm and extend the prevailing downtrend, but they have yet to achieve strong results — The pair continues to stay close

Author: Evangelos Poulakis

05:26 2025-03-26 UTC+2

2

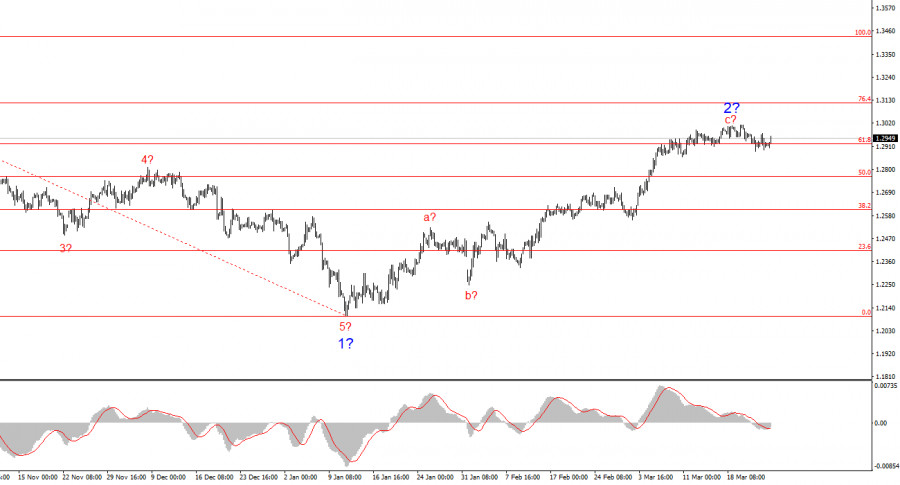

Fundamental analysisGBP/USD Pair Overview – March 26: The Pound Isn't Even Trying. Inertial Growth Continues

The GBP/USD currency pair resumed its upward movement on Tuesday. It did so on a day when there were no significant events in the UK, and the only noteworthy reportAuthor: Paolo Greco

03:40 2025-03-26 UTC+2

3

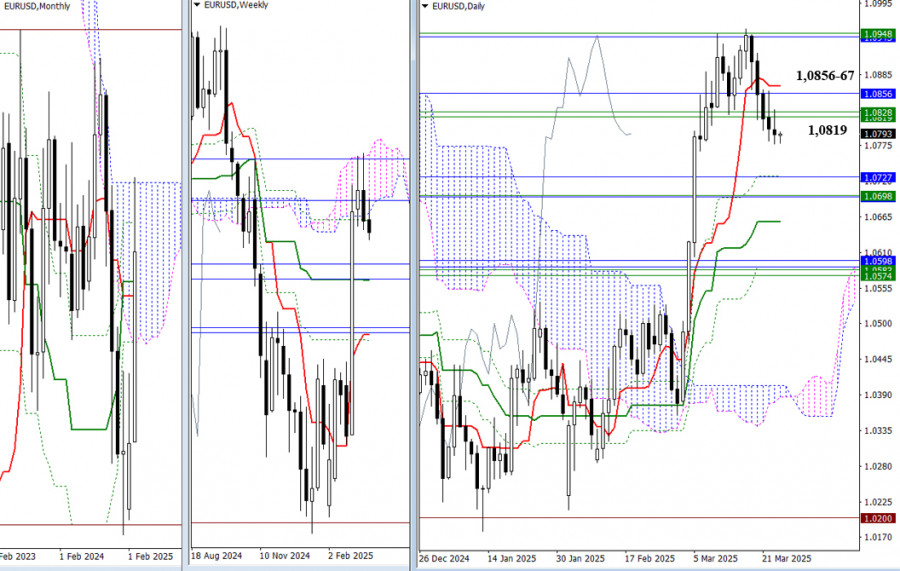

The EUR/USD currency pair traded with low volatility on Tuesday. There have been times when the euro would crawl just 40 pips a day, and while current volatility isn't extremelyAuthor: Paolo Greco

03:40 2025-03-26 UTC+2

5

- Trading plan

Trading Recommendations and Analysis for GBP/USD on March 26: The Pound Continues to Swing

The GBP/USD currency pair showed growth again on Tuesday. "Again," because recently, all movements of the British currency resemble a "swing" or a "roller coaster" – first up, then downAuthor: Paolo Greco

03:40 2025-03-26 UTC+2

7

Trading planTrading Recommendations and Analysis for EUR/USD on March 26: The Euro Continues Its Sluggish Decline

The EUR/USD currency pair traded with only minimal gains on Tuesday, but the overall trend on the hourly timeframe remains bearish following the price's exit from the ascending channelAuthor: Paolo Greco

03:40 2025-03-26 UTC+2

6

A mixed situation has developed around the EUR/USD pair. On the one hand, the bearish sentiment prevails: last week, the price reached a 5-month high at 1.0955, while on TuesdayAuthor: Irina Manzenko

00:59 2025-03-26 UTC+2

36

- The wave pattern for GBP/USD remains somewhat ambiguous but still manageable. Currently, there is a high probability of a long-term downward trend forming. Wave 5 has taken a convincing shape

Author: Chin Zhao

19:36 2025-03-25 UTC+2

43

Trade Breakdown and Tips for Trading the Japanese Yen The test of the 150.68 level occurred when the MACD indicator had just started moving upward from the zero line, whichAuthor: Jakub Novak

19:29 2025-03-25 UTC+2

46

Trade Breakdown and Tips for Trading the British Pound The test of the 1.2911 level occurred when the MACD indicator had already moved significantly below the zero mark, which limitedAuthor: Jakub Novak

19:26 2025-03-25 UTC+2

38