交易员计算器

Take advantage of a trader’s calculator by InstaForex to estimate the following parameters:

- a margin size per trade

- a pip value

All you need to do is enter a few basic data such as a particular financial instrument, the currency of your account, a trade size in lots, and leverage. Hence, you can reckon a trading plan for 300+ trading instruments that will save a lot of your time.

If you want to use a trader’s calculator by InstaForex, you do not have to register in advance or install any software. Parameters entered are processed online. The company’s powerful servers ensure flawless connection so that a trader can instantly figure out the best market entry point and other variants of a trade.

Important!

A pip value for currency pairs is calculated based on the current exchange rate of a particular pair.

Please take notice that 1 lot with InstaForex equals 10,000 units of a base currency.

Here are formulas for calculating a pip value of currency pairs and CFDs.

Calculation of a pip value:

1. XXX/USD

Pip value = 1 * (number of lots)

2. USD/XXX

Pip value = 1 / (USD/XXX) * (number of lots)

3. AAA/BBB

A pip value = (AAA/USD) / (AAA/BBB) * (number of lots)

Calculation of a pip value for CFDs:

Pip value = number of contracts * contract size * tick value

Why does InstaForex suggest a lot size of 10,000 instead of a standard lot size of 100,000 units of a base currency?

InstaForex offers its clients an opportunity to trade Forex applying three lot sizes in parallel within the same trading account. Three lot sizes are designated as Micro Forex, Mini Forex, and Standard Forex. To put this technology into practice, the company introduced an unconventional lot size of 10,000 units. For example, if a trade size equals 0.01 lot, this makes a pip value as low as $0.01. In other words, this is an absolute minimum that allows holders of accounts with $5,000 - $10,000 to manage their risks with utmost efficiency. Besides, a lot size of 10,000 units simplifies calculations of a pip value when opening positions.

Look at the following trade parameters:

- Trade size is 0.01 InstaForex lot = pip value is $0.01

- Trade size is 0.1 InstaForex lot = pip value is $0.1

- Trade size is 1 InstaForex lot = pip value is $1

- Trade size is 10 InstaForex lots = pip value is $10

- Trade size is 100 InstaForex lots = pip value is $100

- Trade size is 1,000 InstaForex lots = pip value is $1,000

A pip value is specified in a base currency of a currency pair’s quote.

InstaForex lots ensure convenient calculations and the possibility of trading three lot sizes inside the common trading account. This is a major advantage of trading conditions with InstaForex.

See Also

- 2025-03-06 14:11:47Switzerland's Unemployment Rate Dips Slightly to 2.9% in FebruaryQuick show2025-03-06 14:11:47Vietnam's Inflation Rate Eases to 0.34% in February 2025Quick show2025-03-06 14:11:47Vietnam's Trade Balance Swings to Deficit in February 2025Quick show2025-03-06 14:11:47Vietnam's Industrial Production Surges to 17.2% in February, Defying Economic ExpectationsQuick show2025-03-06 14:11:47Vietnam's Foreign Direct Investment Surges Amidst Economic GrowthQuick show2025-03-06 14:11:47Vietnam's Retail Sales Growth Slows Slightly in FebruaryQuick show2025-03-06 14:11:47Vietnam's Inflation Cools Down in February as CPI Drops to 2.91%Quick show2025-03-06 14:11:47Australia Sees Decline in Building Approvals as Growth Slows in JanuaryQuick show2025-03-06 14:11:47Australia's Import Activity Sheds Significant Gains, Dips to -0.3% in JanuaryQuick show2025-03-06 14:11:47Australia's Trade Surplus Sees a Significant Rise in January 2025Quick show

- 2025-03-06 14:11:47Ukraine Hikes Interest Rates to Combat Inflationary PressuresQuick show2025-03-06 14:11:47Turkey's Gross FX Reserves Witness a Decline, Hitting $94.76 BillionQuick show2025-03-06 14:11:47Turkey's FX Reserves Dip to New Lows, Signaling Economic StrainQuick show2025-03-06 14:11:47Canadian Leading Index Declines to 0.16% in FebruaryQuick show2025-03-06 14:11:47Ireland's GNP Plummets by an Unexpected 8.3%, Marking a Sharp Economic ContractionQuick show2025-03-06 14:11:47Irish Economy Experiences Sharp Downturn in Fourth Quarter GNPQuick show2025-03-06 14:11:47Latvian Industrial Production Rebounds: Hits 2.3% Growth in JanuaryQuick show2025-03-06 14:11:47Latvian Industrial Production Sees Positive Growth in January, Rebounding from December DeclineQuick show2025-03-06 14:11:47Turkish Overnight Borrowing Rate Drops to 39.50% Amidst Inflation ConcernsQuick show2025-03-06 14:11:47Turkey Slashes Overnight Lending Rate to 45.50% in February, Signaling a Shift in Monetary PolicyQuick show

- 2025-03-06 14:11:47Turkey Lowers One-Week Repo Rate to 42.50% Amid Economic RecalibrationQuick show2025-03-06 14:11:47Irish Economic Surge: GDP Soars to 9.2% in Fourth QuarterQuick show2025-03-06 14:11:47Ireland's GDP Growth Slows to 3.6% in Q4 2024Quick show2025-03-06 14:11:47Latvia's Current Account Swings to Surplus: A Turnaround in Q4 2024Quick show2025-03-06 14:11:47German Car Registrations Plummet Further in February: A Worrying Economic IndicatorQuick show2025-03-06 14:11:47French 10-Year OAT Auction Sees Yield Climb to 3.51%Quick show2025-03-06 14:11:47Euro Zone Retail Sales Witness Drop in January 2025 Amid Economic SlowdownQuick show2025-03-06 14:11:47Euro Zone Retail Sales Slump in January: A 0.3% DeclineQuick show2025-03-06 14:11:47Spain's 7-Year Obligacion Auction Sees Yield Increase to 3.067%Quick show2025-03-06 14:11:47Spain's 10-Year Obligacion Yield Rises to 3.507% Amid Market AdjustmentsQuick show

- 2025-03-06 14:11:47UK Construction Industry Stumbles as PMI Falls in FebruaryQuick show2025-03-06 14:11:47South Africa's Current Account Deficit Narrows to -0.40% of GDP in Fourth Quarter 2024Quick show2025-03-06 14:11:47South Africa's Current Account Deficit Narrows in the Fourth QuarterQuick show2025-03-06 14:11:47Downward Trend Continues: HCOB France Construction PMI Falls to 39.8 in FebruaryQuick show2025-03-06 14:11:47Italy's Construction PMI Dips Below Noir: A Warning for Economic EnthusiastsQuick show2025-03-06 14:11:47Eurozone Construction PMI Falls to New Lows in February 2025Quick show2025-03-06 14:11:47Germany's Construction Sector Faces Further Decline as February PMI Drops to 41.2Quick show2025-03-06 14:11:47Namibia's CPI Growth Decelerates Significantly in FebruaryQuick show2025-03-06 14:11:47Namibia's CPI Shows Uptick in February, Climbing to 3.60%Quick show2025-03-06 14:11:47Czech Republic Sees Decrease in Gross Wage Growth in Q4 2024Quick show

- 2025-03-06 14:11:47Brazil's IPC-Fipe Inflation Index Climbs to 0.51% in FebruaryQuick show2025-03-06 14:11:47Hungary's Retail Sales Surge by 4.7% in January 2025, Marking a Significant TurnaroundQuick show2025-03-06 14:11:47Hungary's Industrial Output Sees Marginal Recovery as Decline Slows in JanuaryQuick show2025-03-06 14:11:47Sweden's CPIF Indicator Nearly Doubles in February 2025 Amid Economic ShiftsQuick show2025-03-06 14:11:47Sweden's CPIF Sees Notable Jump to 2.9% in February Year-Over-YearQuick show2025-03-06 14:11:47Sweden's Current Account Surplus Jumps in Fourth Quarter of 2024Quick show2025-03-06 14:11:47Sweden's CPI Reveals Inflation Increase in February 2025 from 0.9% to 1.3%Quick show2025-03-06 14:11:47Sweden's CPI Jumps to 0.6% in February: A Sign of Reversing Trends?Quick show2025-03-06 14:11:47Malaysia's Interest Rate Holds Steady at 3.00% Amid Global Economic UncertaintyQuick show2025-03-06 14:11:47Swiss Unemployment Rate Holds Steady at 2.7% in FebruaryQuick show

- 2025-03-06 14:11:47Switzerland's Unemployment Rate Dips Slightly to 2.9% in FebruaryQuick show2025-03-06 14:11:47Vietnam's Inflation Rate Eases to 0.34% in February 2025Quick show2025-03-06 14:11:47Vietnam's Trade Balance Swings to Deficit in February 2025Quick show2025-03-06 14:11:47Vietnam's Industrial Production Surges to 17.2% in February, Defying Economic ExpectationsQuick show2025-03-06 14:11:47Vietnam's Foreign Direct Investment Surges Amidst Economic GrowthQuick show2025-03-06 14:11:47Vietnam's Retail Sales Growth Slows Slightly in FebruaryQuick show2025-03-06 14:11:47Vietnam's Inflation Cools Down in February as CPI Drops to 2.91%Quick show2025-03-06 14:11:47Australia Sees Decline in Building Approvals as Growth Slows in JanuaryQuick show2025-03-06 14:11:47Australia's Import Activity Sheds Significant Gains, Dips to -0.3% in JanuaryQuick show2025-03-06 14:11:47Australia's Trade Surplus Sees a Significant Rise in January 2025Quick show

- 2025-03-06 14:11:47Ukraine Hikes Interest Rates to Combat Inflationary PressuresQuick show2025-03-06 14:11:47Turkey's Gross FX Reserves Witness a Decline, Hitting $94.76 BillionQuick show2025-03-06 14:11:47Turkey's FX Reserves Dip to New Lows, Signaling Economic StrainQuick show2025-03-06 14:11:47Canadian Leading Index Declines to 0.16% in FebruaryQuick show2025-03-06 14:11:47Ireland's GNP Plummets by an Unexpected 8.3%, Marking a Sharp Economic ContractionQuick show2025-03-06 14:11:47Irish Economy Experiences Sharp Downturn in Fourth Quarter GNPQuick show2025-03-06 14:11:47Latvian Industrial Production Rebounds: Hits 2.3% Growth in JanuaryQuick show2025-03-06 14:11:47Latvian Industrial Production Sees Positive Growth in January, Rebounding from December DeclineQuick show2025-03-06 14:11:47Turkish Overnight Borrowing Rate Drops to 39.50% Amidst Inflation ConcernsQuick show2025-03-06 14:11:47Turkey Slashes Overnight Lending Rate to 45.50% in February, Signaling a Shift in Monetary PolicyQuick show

Spring brings luck! Win $8,000 with InstaForex!

International Women's Day is a time for gifts, spring, and new opportunities! As the most vibrant holiday of the year approaches, InstaForex is launching its traditional Chancy Deposit contest! You have a unique chance to win $8,000 and make this holiday truly unforgettable! How to participate? It's simple: Fund your InstaForex trading account Wait for the winner to be announced What to do with your prize money? Anything you want: dream shopping, an unforgettable trip, or new, more profitable investments. The money is in your hands! Hurry, the campaign is time-limited! Top up your account and join the race for $8,000 today. Who knows, this could be your lucky day. Register.

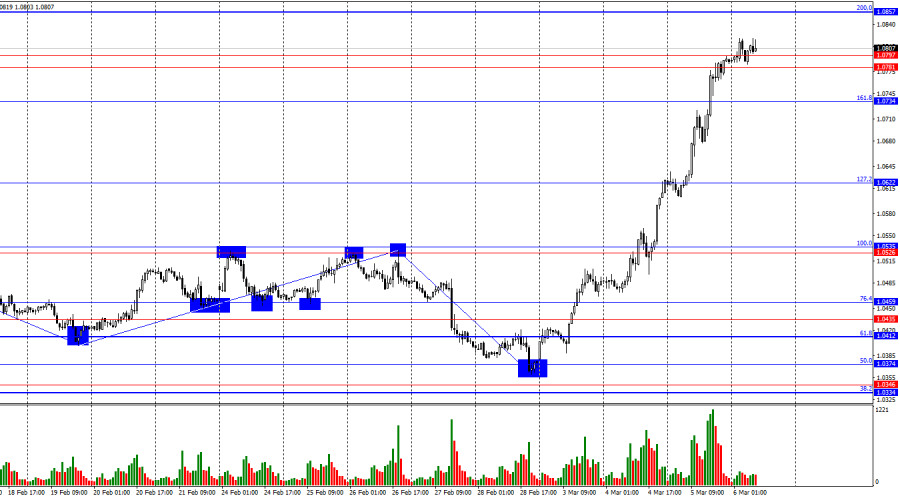

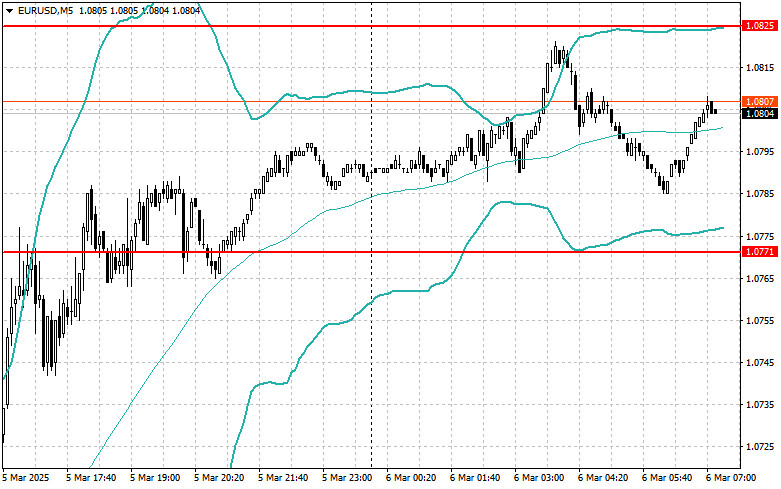

- On Wednesday, the EUR/USD pair continued its upward movement, consolidating above the 161.8% Fibonacci retracement level at 1.0734 and breaking through the resistance zone of 1.0781–1.0797. This suggests that

Author: Samir Klishi

11:55 2025-03-06 UTC+2

12

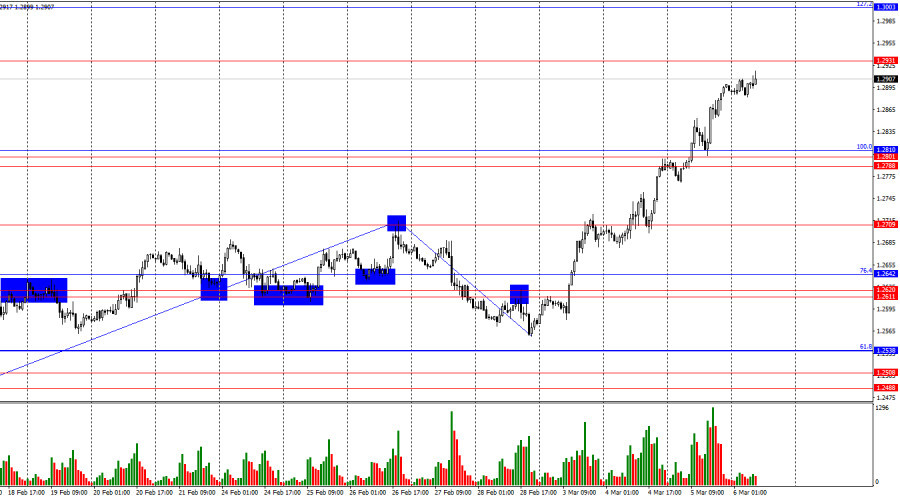

On the hourly chart, GBP/USD continued its upward movement on Wednesday after consolidating above the resistance zone of 1.2788–1.2801 and the 100.0% corrective level at 1.2810. The bullsAuthor: Samir Klishi

11:52 2025-03-06 UTC+2

15

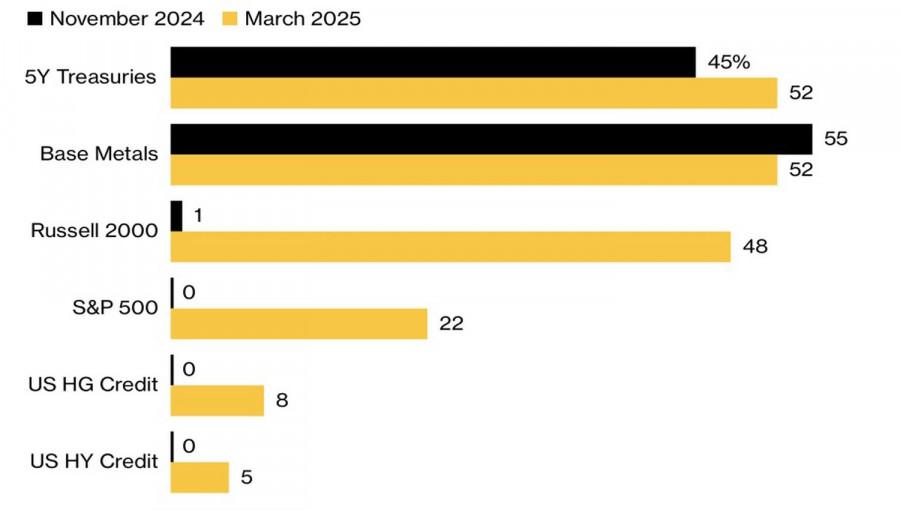

Yesterday, futures on U.S. stock indices rebounded from their weekly lows. During today's Asian session, S&P 500 futures gained 0.1%, while the technology-heavy NASDAQ rose 0.2%.The bond marketAuthor: Jakub Novak

11:29 2025-03-06 UTC+2

22

- Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Author: Sebastian Seliga

11:14 2025-03-06 UTC+2

42

The S&P 500 found solid ground after the White House decided to exempt the auto industry from the 25% tariffs imposed on Mexico and Canada. Donald Trump and his teamAuthor: Marek Petkovich

11:03 2025-03-06 UTC+2

13

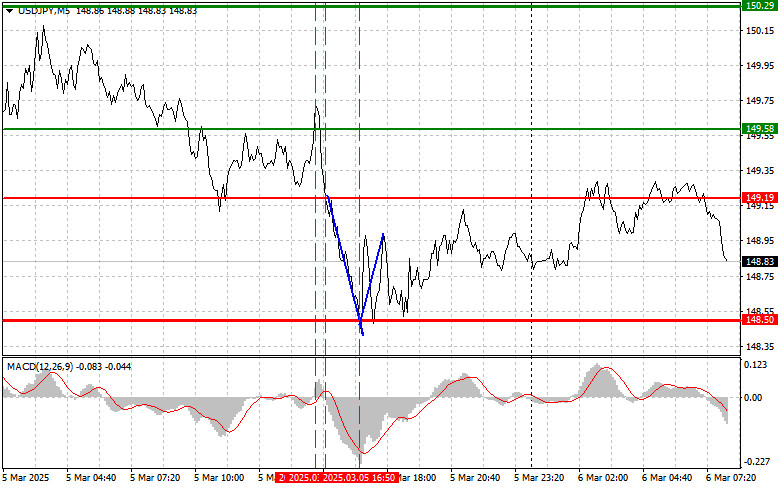

ForecastUSD/JPY: Simple Trading Tips for Beginner Traders on March 6. Review of Yesterday's Forex Trades

The test of the 149.58 price level occurred when the MACD indicator was beginning to move upward from the zero mark, confirming the correct entry point for buying the dollarAuthor: Jakub Novak

09:02 2025-03-06 UTC+2

17

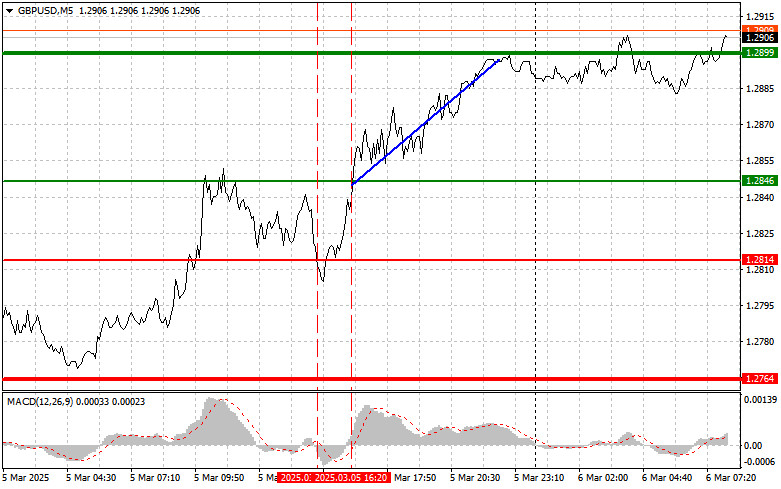

- Forecast

GBP/USD: Simple Trading Tips for Beginner Traders on March 6. Review of Yesterday's Forex Trades

The test of the 1.2814 price level occurred when the MACD indicator was beginning to move downward from the zero mark, confirming the correct entry point for selling the poundAuthor: Jakub Novak

09:02 2025-03-06 UTC+2

25

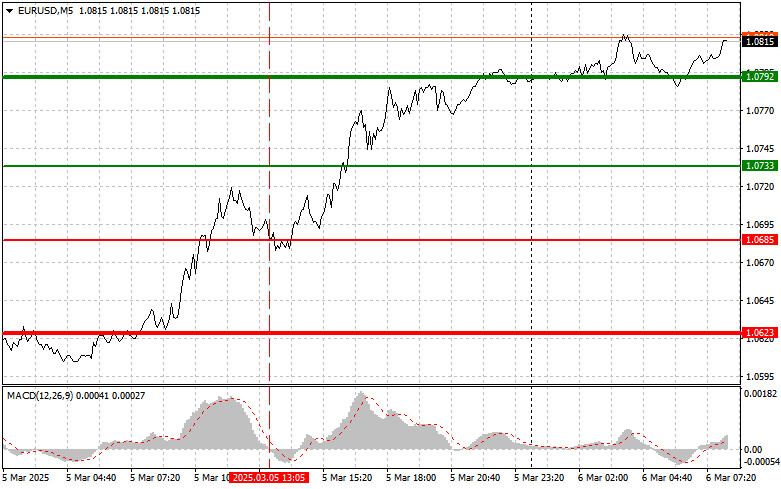

ForecastEUR/USD: Simple Trading Tips for Beginner Traders on March 6. Review of Yesterday's Forex Trades

The test of the 1.0685 price level occurred when the MACD indicator was beginning to move downward from the zero mark, confirming the correct entry point for selling the euroAuthor: Jakub Novak

09:02 2025-03-06 UTC+2

25

The euro and the pound continue to rise against the US dollar. Discussions about the need for further rate cuts in the US are putting pressure on the dollar, whileAuthor: Miroslaw Bawulski

08:12 2025-03-06 UTC+2

18