交易员计算器

Take advantage of a trader’s calculator by InstaForex to estimate the following parameters:

- a margin size per trade

- a pip value

All you need to do is enter a few basic data such as a particular financial instrument, the currency of your account, a trade size in lots, and leverage. Hence, you can reckon a trading plan for 300+ trading instruments that will save a lot of your time.

If you want to use a trader’s calculator by InstaForex, you do not have to register in advance or install any software. Parameters entered are processed online. The company’s powerful servers ensure flawless connection so that a trader can instantly figure out the best market entry point and other variants of a trade.

Important!

A pip value for currency pairs is calculated based on the current exchange rate of a particular pair.

Please take notice that 1 lot with InstaForex equals 10,000 units of a base currency.

Here are formulas for calculating a pip value of currency pairs and CFDs.

Calculation of a pip value:

1. XXX/USD

Pip value = 1 * (number of lots)

2. USD/XXX

Pip value = 1 / (USD/XXX) * (number of lots)

3. AAA/BBB

A pip value = (AAA/USD) / (AAA/BBB) * (number of lots)

Calculation of a pip value for CFDs:

Pip value = number of contracts * contract size * tick value

Why does InstaForex suggest a lot size of 10,000 instead of a standard lot size of 100,000 units of a base currency?

InstaForex offers its clients an opportunity to trade Forex applying three lot sizes in parallel within the same trading account. Three lot sizes are designated as Micro Forex, Mini Forex, and Standard Forex. To put this technology into practice, the company introduced an unconventional lot size of 10,000 units. For example, if a trade size equals 0.01 lot, this makes a pip value as low as $0.01. In other words, this is an absolute minimum that allows holders of accounts with $5,000 - $10,000 to manage their risks with utmost efficiency. Besides, a lot size of 10,000 units simplifies calculations of a pip value when opening positions.

Look at the following trade parameters:

- Trade size is 0.01 InstaForex lot = pip value is $0.01

- Trade size is 0.1 InstaForex lot = pip value is $0.1

- Trade size is 1 InstaForex lot = pip value is $1

- Trade size is 10 InstaForex lots = pip value is $10

- Trade size is 100 InstaForex lots = pip value is $100

- Trade size is 1,000 InstaForex lots = pip value is $1,000

A pip value is specified in a base currency of a currency pair’s quote.

InstaForex lots ensure convenient calculations and the possibility of trading three lot sizes inside the common trading account. This is a major advantage of trading conditions with InstaForex.

See Also

From us with love: win $5,000 for Valentine's Day!

Valentine's Day is just around the corner — the perfect time to delight your loved ones with gifts. Of course, we could not miss out on this wonderful occasion, so we have launched the Chancy Deposit promotion just in time for the holiday, giving you the chance to win $5,000! Anyone can try their luck! All you need to do is just top up your trading account anytime from the start to the end of February, while the promotion is active. Grab your chance to receive a luxurious gift by February 14th! May fortune be on your side! Register.

-

DeepSeek in focus: five key questions

DeepSeek in focus: five key questions -

Top 5 altcoins to show explosive growth in 2025

Top 5 altcoins to show explosive growth in 2025 -

Key developments in Artificial Intelligence (AI) expected in 2025

Key developments in Artificial Intelligence (AI) expected in 2025 -

Ten books recommended by billionaires

Ten books recommended by billionaires -

Top five countries for wine tourism

Top five countries for wine tourism -

Countries with highest levels of economic inequality

Countries with highest levels of economic inequality -

Best Christmas markets in Europe

Best Christmas markets in Europe

- 2025-02-13 11:40:56New Zealand Inflation Expectations Stable at 2.1% in Q1 2025Quick show2025-02-13 11:40:56U.K. RICS House Price Balance Dips to 22% in January 2025Quick show2025-02-13 11:40:56Australian Inflation Expectations Rise to 4.6% in FebruaryQuick show2025-02-13 11:40:56Japan's Producer Price Index Surges to 4.2% in January 2025Quick show2025-02-13 11:40:56Japan's PPI Remains Steady at 0.3% in JanuaryQuick show2025-02-13 11:40:56New Zealand Electronic Card Retail Sales Slump in January 2025Quick show2025-02-13 11:40:56New Zealand Sees Slight Recovery in Electronic Card Retail Sales in JanuaryQuick show2025-02-13 11:40:56U.S. Federal Budget Deficit Widens in January 2025Quick show2025-02-13 11:40:56U.S. 10-Year Note Auction Sees Slight Yield Decrease to 4.632%Quick show2025-02-13 11:40:56Brazil Experiences Sharp Drop in Foreign Exchange FlowsQuick show

- 2025-02-13 11:40:56Rwanda's Repo Rate Remains Stable at 6.50% as of February 2025Quick show2025-02-13 11:40:56South Africa's Mining Production Declines Further in DecemberQuick show2025-02-13 11:40:56South Africa's Gold Production Shows Signs of Recovery in DecemberQuick show2025-02-13 11:40:56Czech Republic Current Account Witnesses Significant Dip in December 2024Quick show2025-02-13 11:40:56Poland's GDP Springs to Growth: A 1.3% Leap in Q4 Signals Economic RecoveryQuick show2025-02-13 11:40:56Poland's Economy Outpaces Expectations with Q4 GDP Surge to 3.2%Quick show2025-02-13 11:40:56Swiss Inflation Rate Softens in January as CPI Growth Slows to 0.4%Quick show2025-02-13 11:40:56Hungarian Industrial Output Decline Expands in DecemberQuick show2025-02-13 11:40:56Switzerland's January CPI Remains Steady at -0.1% Amidst Economic UncertaintyQuick show2025-02-13 11:40:56UK Index of Services Shows Modest Growth - Hits 0.2% in Latest UpdateQuick show

- 2025-02-13 11:40:56Lithuanian Producer Prices Plummet in January: Sharp Decline Marks Economic ChallengeQuick show2025-02-13 11:40:56Lithuania's Producer Price Index Surges in January 2025Quick show2025-02-13 11:40:56UK Business Investment Plummets by Year-End, Sinking to -0.7% in Q4 2024Quick show2025-02-13 11:40:56UK Business Investment Takes a Sharp Turn in Q4 2024Quick show2025-02-13 11:40:56UK GDP Growth Surges to 1.4% in Fourth Quarter of 2024Quick show2025-02-13 11:40:56UK GDP Shows Marginal Growth in Q4 2024, Rising by 0.1% Quarter Over QuarterQuick show2025-02-13 11:40:56Turkey's Current Account Deficit Widens to $4.65 Billion in DecemberQuick show2025-02-13 11:40:56Philippines Central Bank Holds Steady at 5.75% Amidst Global Economic UncertaintyQuick show2025-02-13 11:40:56Germany's Steady Inflation: HICP Holds at 2.8% in JanuaryQuick show2025-02-13 11:40:56Germany's Inflation Gauge Runs Status Quo as HICP Remains Steady in JanuaryQuick show

- 2025-02-13 11:40:56German Inflation Holds Steady: Consumer Prices Unchanged at 2.3% in JanuaryQuick show2025-02-13 11:40:56Germany's Consumer Price Index Holds Steady at -0.2% in JanuaryQuick show2025-02-13 11:40:56United Kingdom's Non-EU Trade Deficit Shrinks as December Figures Show ImprovementQuick show2025-02-13 11:40:56UK Trade Deficit Retreats by £1.86 Billion in DecemberQuick show2025-02-13 11:40:56UK Manufacturing Production Decline Deepens in DecemberQuick show2025-02-13 11:40:56UK Industrial Production Dips Further by 0.1% in DecemberQuick show2025-02-13 11:40:56UK GDP Growth Surges to 1.5% in December, Boosting Economic Optimism for 2025Quick show2025-02-13 11:40:56UK GDP Shows Resilient Uptick to 0.4% in December 2024Quick show2025-02-13 11:40:56U.K. Construction Output Surges to 1.5% in DecemberQuick show2025-02-13 11:40:56Romania's Industrial Production Shows Steeper Decline in December 2024Quick show

- 2025-02-13 11:40:56Romania's Industrial Production Declines Further in DecemberQuick show2025-02-13 11:40:56UK GDP Shows Signs of Recovery with Slight Growth in DecemberQuick show2025-02-13 11:40:56UK Construction Output Declines in December: Latest Figures Show a Negative ShiftQuick show2025-02-13 11:40:56UK Manufacturing Bounces Back: December Sees Positive Growth After November DipQuick show2025-02-13 11:40:56UK Industrial Production Rebounds in December with 0.5% UptickQuick show2025-02-13 11:40:56Dutch CPI Dips into Negative Territory in January 2025Quick show2025-02-13 11:40:56Dutch Inflation Eases to 3.3% in January, Bolstering Economic OptimismQuick show2025-02-13 11:40:56Thailand's Consumer Confidence Inches Up in JanuaryQuick show2025-02-13 11:40:56South Korea’s M3 Money Supply Sees Gradual Increase in DecemberQuick show2025-02-13 11:40:56South Korea's M2 Money Supply Growth Slows in DecemberQuick show

- 2025-02-13 11:40:56New Zealand Inflation Expectations Stable at 2.1% in Q1 2025Quick show2025-02-13 11:40:56U.K. RICS House Price Balance Dips to 22% in January 2025Quick show2025-02-13 11:40:56Australian Inflation Expectations Rise to 4.6% in FebruaryQuick show2025-02-13 11:40:56Japan's Producer Price Index Surges to 4.2% in January 2025Quick show2025-02-13 11:40:56Japan's PPI Remains Steady at 0.3% in JanuaryQuick show2025-02-13 11:40:56New Zealand Electronic Card Retail Sales Slump in January 2025Quick show2025-02-13 11:40:56New Zealand Sees Slight Recovery in Electronic Card Retail Sales in JanuaryQuick show2025-02-13 11:40:56U.S. Federal Budget Deficit Widens in January 2025Quick show2025-02-13 11:40:56U.S. 10-Year Note Auction Sees Slight Yield Decrease to 4.632%Quick show2025-02-13 11:40:56Brazil Experiences Sharp Drop in Foreign Exchange FlowsQuick show

- 2025-02-13 11:40:56Rwanda's Repo Rate Remains Stable at 6.50% as of February 2025Quick show2025-02-13 11:40:56South Africa's Mining Production Declines Further in DecemberQuick show2025-02-13 11:40:56South Africa's Gold Production Shows Signs of Recovery in DecemberQuick show2025-02-13 11:40:56Czech Republic Current Account Witnesses Significant Dip in December 2024Quick show2025-02-13 11:40:56Poland's GDP Springs to Growth: A 1.3% Leap in Q4 Signals Economic RecoveryQuick show2025-02-13 11:40:56Poland's Economy Outpaces Expectations with Q4 GDP Surge to 3.2%Quick show2025-02-13 11:40:56Swiss Inflation Rate Softens in January as CPI Growth Slows to 0.4%Quick show2025-02-13 11:40:56Hungarian Industrial Output Decline Expands in DecemberQuick show2025-02-13 11:40:56Switzerland's January CPI Remains Steady at -0.1% Amidst Economic UncertaintyQuick show2025-02-13 11:40:56UK Index of Services Shows Modest Growth - Hits 0.2% in Latest UpdateQuick show

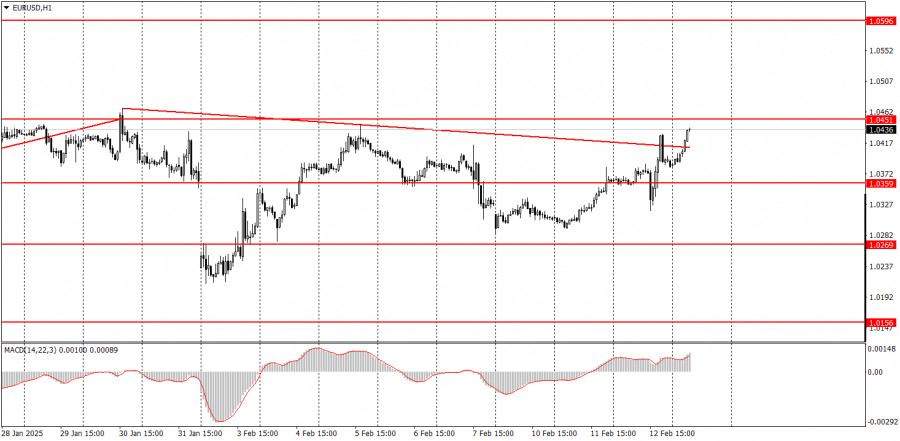

- Potential for the downside movement on EUR/USD

Author: Petar Jacimovic

11:10 2025-02-13 UTC+2

1

Recent news about negotiations between Russia and the U.S. concerning Ukraine has generated significant interest in the information space. The market is still processing this development, but the initial responseAuthor: Pati Gani

10:08 2025-02-13 UTC+2

0

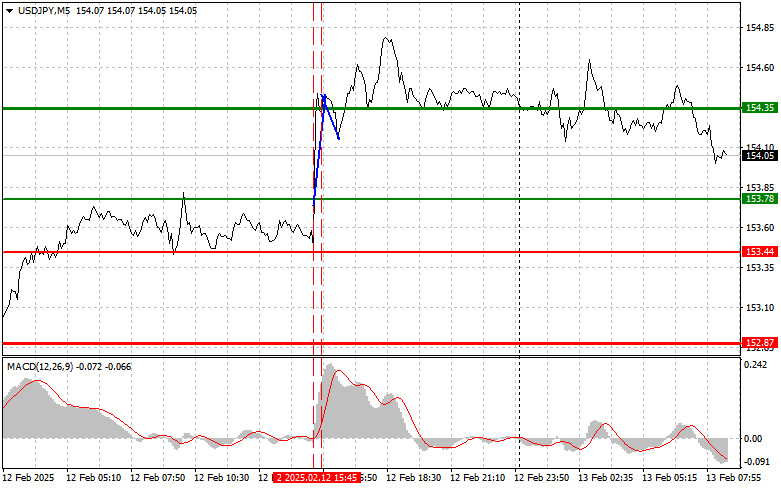

ForecastUSD/JPY: Simple Trading Tips for Beginner Traders on February 13. Analysis of Yesterday's Forex Trades

A test of the 153.78 price level occurred when the MACD indicator had just begun moving upward from the zero mark, confirming a valid buy entry for the U.S. dollarAuthor: Jakub Novak

10:08 2025-02-13 UTC+2

1

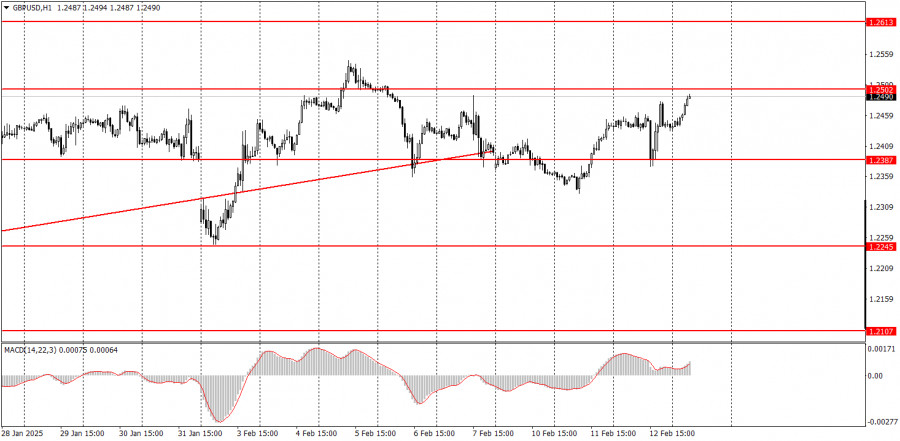

- Forecast

GBP/USD: Simple Trading Tips for Beginner Traders on February 13. Analysis of Yesterday's Forex Trades

A test of the 1.2433 price level occurred when the MACD indicator began to move downward from the zero mark, confirming a valid sell entry for the poundAuthor: Jakub Novak

10:08 2025-02-13 UTC+2

1

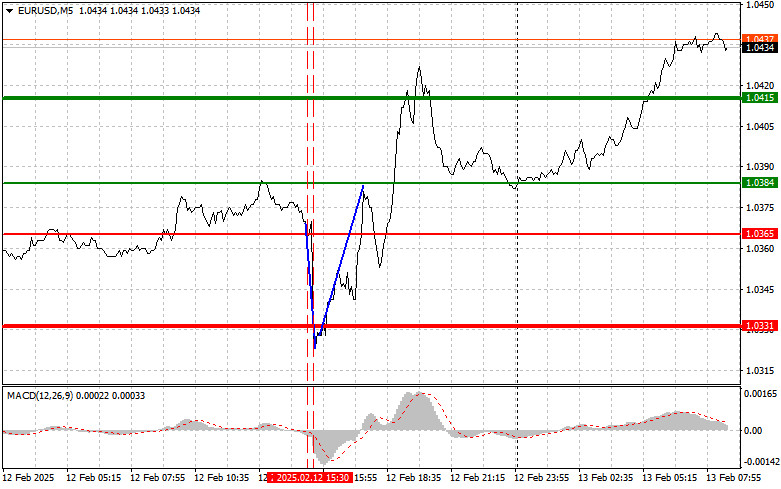

ForecastEUR/USD: Simple Trading Tips for Beginner Traders on February 13. Analysis of Yesterday's Forex Trades

A test of the 1.0365 price level occurred when the MACD indicator had just begun to move downward from the zero mark, confirming a valid sell entry for the euroAuthor: Jakub Novak

10:08 2025-02-13 UTC+2

2

Fundamental analysisWhat to Pay Attention to on February 13? A Breakdown of Fundamental Events for Beginners

A significant number of macroeconomic events are scheduled for Thursday, but few are truly important. The main focus will be on the UK GDP data for Q4 and the industrialAuthor: Paolo Greco

08:22 2025-02-13 UTC+2

5

- Trading plan

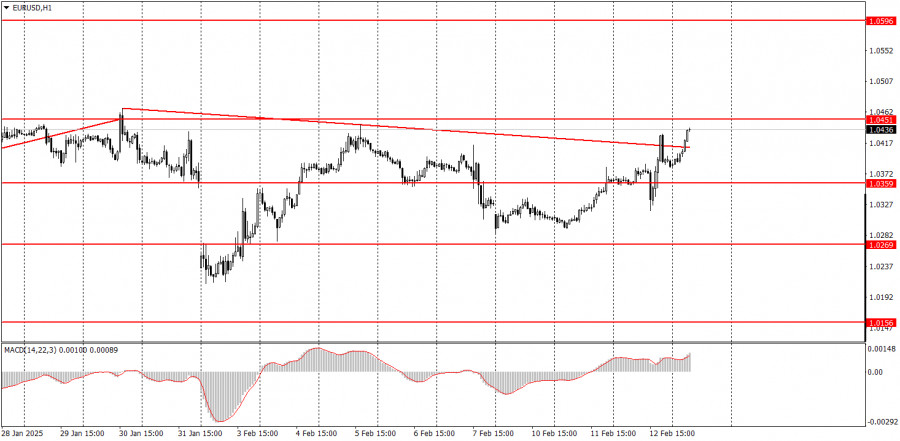

How to Trade the EUR/USD Pair on February 13? Simple Tips and Trade Analysis for Beginners

Analysis of Wednesday's Trades 1H Chart of EUR/USD The EUR/USD currency pair experienced significant growth on Tuesday, with the upward trend continuing overnight. What caused the euro to riseAuthor: Paolo Greco

07:41 2025-02-13 UTC+2

7

Trading planHow to Trade the GBP/USD Pair on February 13? Simple Tips and Trade Analysis for Beginners

Analysis of Wednesday's Trades 1H Chart of GBP/USD The GBP/USD pair traded higher on Wednesday, despite no reason for it. The market's reaction to the day's only significant report—U.S. inflationAuthor: Paolo Greco

07:41 2025-02-13 UTC+2

6

U.S. inflation data surpassed expectations. The core Consumer Price Index (CPI) rose from 3.2% year-over-year (YoY) to 3.3% YoY, contrary to the forecasted decrease to 3.1% YoY. The headlineAuthor: Laurie Bailey

07:41 2025-02-13 UTC+2

14