交易员计算器

Take advantage of a trader’s calculator by InstaForex to estimate the following parameters:

- a margin size per trade

- a pip value

All you need to do is enter a few basic data such as a particular financial instrument, the currency of your account, a trade size in lots, and leverage. Hence, you can reckon a trading plan for 300+ trading instruments that will save a lot of your time.

If you want to use a trader’s calculator by InstaForex, you do not have to register in advance or install any software. Parameters entered are processed online. The company’s powerful servers ensure flawless connection so that a trader can instantly figure out the best market entry point and other variants of a trade.

Important!

A pip value for currency pairs is calculated based on the current exchange rate of a particular pair.

Please take notice that 1 lot with InstaForex equals 10,000 units of a base currency.

Here are formulas for calculating a pip value of currency pairs and CFDs.

Calculation of a pip value:

1. XXX/USD

Pip value = 1 * (number of lots)

2. USD/XXX

Pip value = 1 / (USD/XXX) * (number of lots)

3. AAA/BBB

A pip value = (AAA/USD) / (AAA/BBB) * (number of lots)

Calculation of a pip value for CFDs:

Pip value = number of contracts * contract size * tick value

Why does InstaForex suggest a lot size of 10,000 instead of a standard lot size of 100,000 units of a base currency?

InstaForex offers its clients an opportunity to trade Forex applying three lot sizes in parallel within the same trading account. Three lot sizes are designated as Micro Forex, Mini Forex, and Standard Forex. To put this technology into practice, the company introduced an unconventional lot size of 10,000 units. For example, if a trade size equals 0.01 lot, this makes a pip value as low as $0.01. In other words, this is an absolute minimum that allows holders of accounts with $5,000 - $10,000 to manage their risks with utmost efficiency. Besides, a lot size of 10,000 units simplifies calculations of a pip value when opening positions.

Look at the following trade parameters:

- Trade size is 0.01 InstaForex lot = pip value is $0.01

- Trade size is 0.1 InstaForex lot = pip value is $0.1

- Trade size is 1 InstaForex lot = pip value is $1

- Trade size is 10 InstaForex lots = pip value is $10

- Trade size is 100 InstaForex lots = pip value is $100

- Trade size is 1,000 InstaForex lots = pip value is $1,000

A pip value is specified in a base currency of a currency pair’s quote.

InstaForex lots ensure convenient calculations and the possibility of trading three lot sizes inside the common trading account. This is a major advantage of trading conditions with InstaForex.

See Also

- 2025-03-29 06:04:11Ghana's Prime Interest Rate Climbs to 28%, An Increase from January's RateQuick show2025-03-29 06:04:11Canada’s Budget Balance Worsens in January, Revealing Deeper DeficitQuick show2025-03-29 06:04:11Canada's Budget Balance Plummets to -$5.13 Billion in January 2025Quick show2025-03-29 06:04:11Baltic Dry Index Continues to FallQuick show2025-03-29 06:04:11US Michigan Consumer Sentiment Revised LowerQuick show2025-03-29 06:04:11Brazilian Real Slides as Labor Market Weakens and Trade Risks MountQuick show2025-03-29 06:04:11US Year-Ahead Inflation Expectations Revised Slightly UpQuick show2025-03-29 06:04:11Michigan Consumers Maintain a Steady Outlook Amid UncertaintyQuick show2025-03-29 06:04:11Consumer Sentiment Dips: Michigan Index Shows Decline in MarchQuick show2025-03-29 06:04:11Michigan 5-Year Inflation Expectations Rise to 4.1% in March 2025Quick show

- 2025-03-29 06:04:11Mexico's Fiscal Balance Worsens Significantly in FebruaryQuick show2025-03-29 06:04:11US Stocks Tumble on Inflation Concerns and Trade DisruptionsQuick show2025-03-29 06:04:11TSX Retreats Amid Trade Tensions and Economic HeadwindsQuick show2025-03-29 06:04:11Crude Oil Eases, But Posts 3rd Weekly GainQuick show2025-03-29 06:04:11Stagnation in CFTC Gold Speculative Net Positions: No Change Observed in Latest Data UpdateQuick show2025-03-29 06:04:11Semi-Stable Shores: New Zealand Dollar Speculative Net Positions Remain UnchangedQuick show2025-03-29 06:04:11Stability in CFTC JPY Speculative Net Positions Marks a Steady Signal Amid Economic VolatilityQuick show2025-03-29 06:04:11CFTC BRL Speculative Net Positions Hold Steady at 40.7K as of March 28, 2025Quick show2025-03-29 06:04:11Australian Dollar Positions Hold Steady Amid Market Speculation: CFTC Data RevealsQuick show2025-03-29 06:04:11Swiss CHF Speculative Net Positions Hold Steady at -34.4K, CFTC ReportsQuick show

- 2025-03-29 06:04:11Stability Mark: CFTC MXN Speculative Net Positions Hold Steady at 56.0KQuick show2025-03-29 06:04:11Canadian Dollar Speculation Remains Stable as CFTC Reports Unchanged Net PositionsQuick show2025-03-29 06:04:11Sharp Decline in Wheat Speculative Positions Reflects Market UncertaintyQuick show2025-03-29 06:04:11CFTC Reports Significant Drop in Soybean Speculative Net Positions as Market Dynamics ShiftQuick show2025-03-29 06:04:11No Change in CFTC Silver Speculative Net Positions Amid Market UncertaintyQuick show2025-03-29 06:04:11Stability in the Market: CFTC Reports Unchanged S&P 500 Speculative Net PositionsQuick show2025-03-29 06:04:11Speculative Net Short Positions in U.S. Natural Gas Widen Further to -131.9KQuick show2025-03-29 06:04:11Speculative Net Positions in Nasdaq 100 Remain Steady at 23.0K, Says CFTCQuick show2025-03-29 06:04:11Crude Oil Speculative Net Positions Surge as Traders Bet on Rising PricesQuick show2025-03-29 06:04:11CFTC Reports Significant Decline in Corn Speculative Net PositionsQuick show

- 2025-03-29 06:04:11Stability in Copper Market as CFTC Speculative Net Positions Hold SteadyQuick show2025-03-29 06:04:11U.S. CFTC Aluminium Speculative Net Positions Hold Steady at 1.9KQuick show2025-03-29 06:04:11Euro Zone's CFTC EUR Speculative Net Positions Steady at 59.4KQuick show2025-03-29 06:04:11GBP Speculative Net Positions Hold Steady Amid Market StabilityQuick show2025-03-29 06:04:11Paraguay GDP Annual Growth Accelerates in Q4Quick show2025-03-29 06:04:11Brazil Economy Adds More Jobs than ExpectedQuick show2025-03-29 06:04:11Brazil's Labor Market Surges: CAGED Net Payroll Jobs Jump to 432K in FebruaryQuick show2025-03-29 06:04:11Wall Street Sinks on Inflation and Trade WorriesQuick show2025-03-29 06:04:11European Stocks End Week LowerQuick show2025-03-29 06:04:11U.S. Baker Hughes Rig Count Drops Slightly, Signaling Stabilization in Oil MarketQuick show

- 2025-03-29 06:04:11U.S. Baker Hughes Oil Rig Count Slips to 484, Reflecting Subtle Dips in Drilling ActivityQuick show2025-03-29 06:04:11FTSE MIB Slides as Trade Concerns, Weak Consumer Confidence WeighQuick show2025-03-29 06:04:11DAX Slumps for Third Day as US Tariff Concerns DeepenQuick show2025-03-29 06:04:11Week Ahead - March 31stQuick show2025-03-29 06:04:11Gold Keeps Smashing RecordsQuick show2025-03-29 06:04:11Ghana Lifts Key Policy Rate to 28%Quick show2025-03-29 06:04:11Dollar Slips Amid Growing Economic ConcernsQuick show2025-03-29 06:04:11Canada Government Budget Gap Widens in JanuaryQuick show2025-03-29 06:04:11Atlanta Fed GDPNow Forecast: U.S. Economic Outlook Dimmed for First Quarter 2025Quick show2025-03-29 06:04:11India Current Account Gap Widens Less than AnticipatedQuick show

- 2025-03-29 06:04:11Ghana's Prime Interest Rate Climbs to 28%, An Increase from January's RateQuick show2025-03-29 06:04:11Canada’s Budget Balance Worsens in January, Revealing Deeper DeficitQuick show2025-03-29 06:04:11Canada's Budget Balance Plummets to -$5.13 Billion in January 2025Quick show2025-03-29 06:04:11Baltic Dry Index Continues to FallQuick show2025-03-29 06:04:11US Michigan Consumer Sentiment Revised LowerQuick show2025-03-29 06:04:11Brazilian Real Slides as Labor Market Weakens and Trade Risks MountQuick show2025-03-29 06:04:11US Year-Ahead Inflation Expectations Revised Slightly UpQuick show2025-03-29 06:04:11Michigan Consumers Maintain a Steady Outlook Amid UncertaintyQuick show2025-03-29 06:04:11Consumer Sentiment Dips: Michigan Index Shows Decline in MarchQuick show2025-03-29 06:04:11Michigan 5-Year Inflation Expectations Rise to 4.1% in March 2025Quick show

- 2025-03-29 06:04:11Mexico's Fiscal Balance Worsens Significantly in FebruaryQuick show2025-03-29 06:04:11US Stocks Tumble on Inflation Concerns and Trade DisruptionsQuick show2025-03-29 06:04:11TSX Retreats Amid Trade Tensions and Economic HeadwindsQuick show2025-03-29 06:04:11Crude Oil Eases, But Posts 3rd Weekly GainQuick show2025-03-29 06:04:11Stagnation in CFTC Gold Speculative Net Positions: No Change Observed in Latest Data UpdateQuick show2025-03-29 06:04:11Semi-Stable Shores: New Zealand Dollar Speculative Net Positions Remain UnchangedQuick show2025-03-29 06:04:11Stability in CFTC JPY Speculative Net Positions Marks a Steady Signal Amid Economic VolatilityQuick show2025-03-29 06:04:11CFTC BRL Speculative Net Positions Hold Steady at 40.7K as of March 28, 2025Quick show2025-03-29 06:04:11Australian Dollar Positions Hold Steady Amid Market Speculation: CFTC Data RevealsQuick show2025-03-29 06:04:11Swiss CHF Speculative Net Positions Hold Steady at -34.4K, CFTC ReportsQuick show

InstaForex – Prime Sponsor of Traders Fair Lagos 2025!

InstaForex is proud to announce its participation in Traders Fair Lagos 2025 – one of the biggest financial events in Africa. As the Prime Sponsor, we warmly invite all traders, investors, and partners to visit our booth for unique opportunities, exclusive bonuses, and expert consultations. Why you can’t miss this event Traders Fair Lagos 2025 is not just an exhibition. It is a global platform to connect with leading financial experts. This event brings together traders, brokers, analysts, and investors from all over the world to explore trends, strategies, and technologies shaping the future of financial markets.

-

Betting on AI: five high-potential stocks to watch

Betting on AI: five high-potential stocks to watch -

World’s top 5 CEOs according to Brand Finance

World’s top 5 CEOs according to Brand Finance -

Wall Street legends: top 10 investors of all time

Wall Street legends: top 10 investors of all time -

Bitcoin's future: 4 factors that could shape it

Bitcoin's future: 4 factors that could shape it -

Five billionaires who gained most wealth in 2024

Five billionaires who gained most wealth in 2024 -

Top 5 cryptocurrencies by market capitalization in 2024

Top 5 cryptocurrencies by market capitalization in 2024 -

Top 5 locations for stargazing

Top 5 locations for stargazing

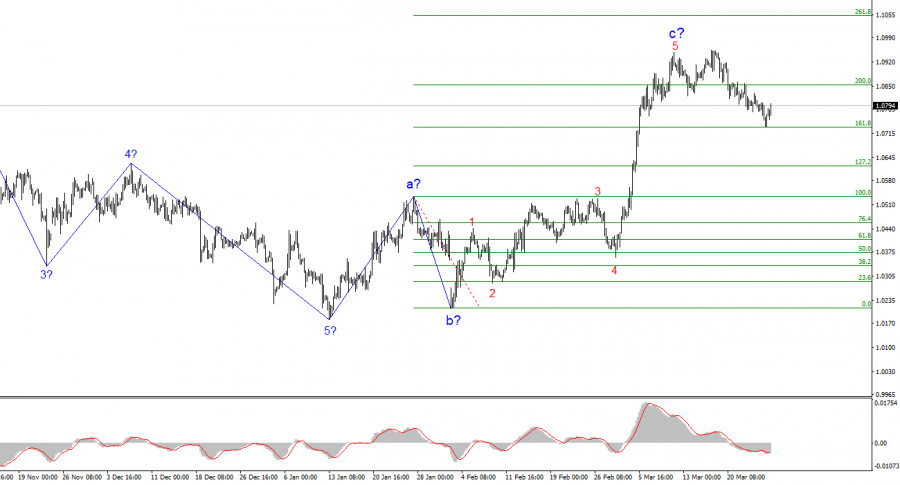

- The wave structure on the 4-hour chart for EUR/USD threatens to evolve into a more complex formation. A new downward structure began forming on September 25, taking the shape

Author: Chin Zhao

20:10 2025-03-28 UTC+2

15

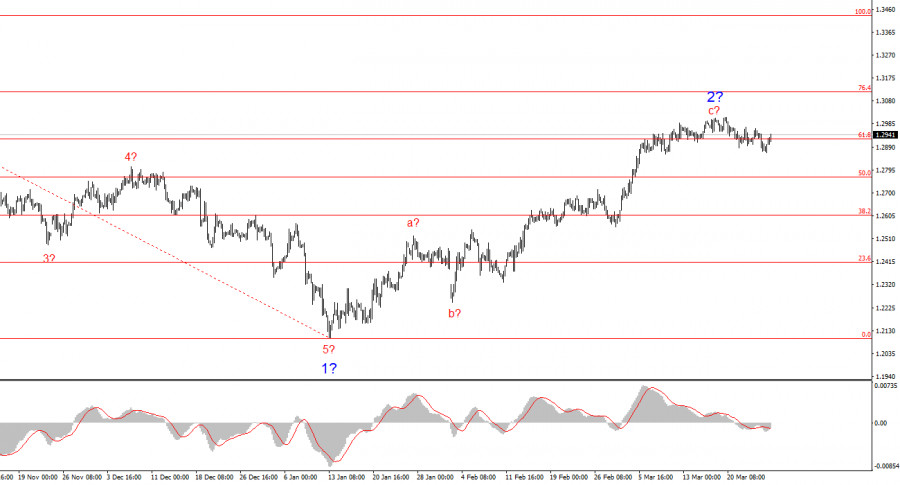

The wave structure of the GBP/USD instrument remains somewhat ambiguous, but overall digestible. At this stage, there is a strong likelihood that a long-term downward trend segment is forming. WaveAuthor: Chin Zhao

20:07 2025-03-28 UTC+2

18

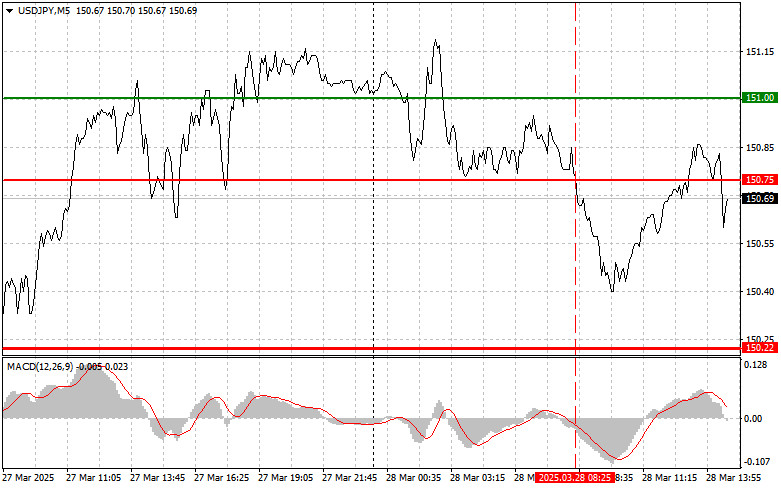

Trade Analysis and Tips for Trading the Japanese Yen The test of the 150.75 level occurred when the MACD indicator had already moved significantly below the zero line, which limitedAuthor: Jakub Novak

20:04 2025-03-28 UTC+2

14

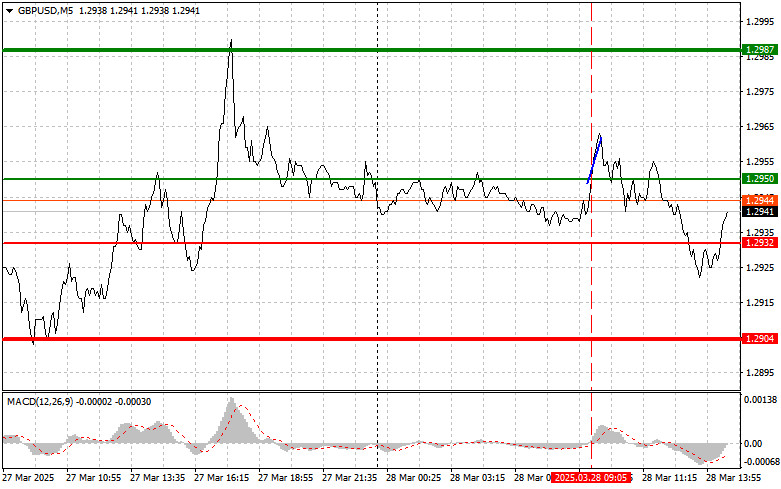

- Trade Analysis and Tips for the British Pound The test of the 1.2950 level occurred just as the MACD indicator began to rise from the zero line, confirming a valid

Author: Jakub Novak

20:00 2025-03-28 UTC+2

10

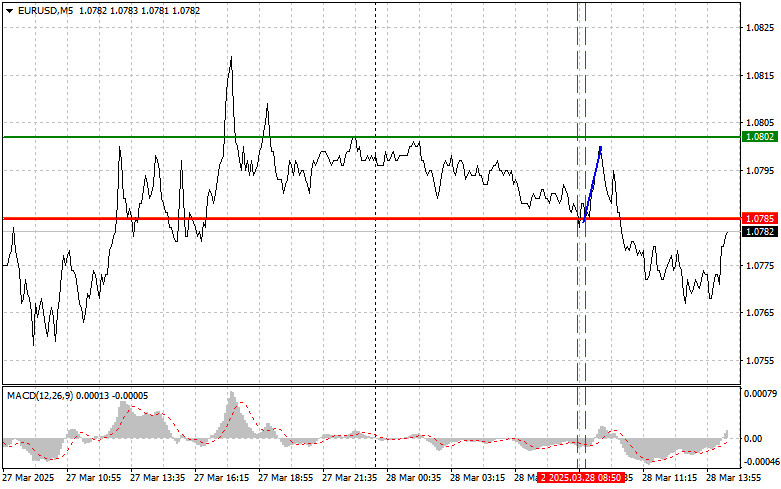

Trade Analysis and Tips for the Euro The price test at 1.0785 occurred when the MACD indicator had already moved significantly below the zero line, which limited the pair's downwardAuthor: Jakub Novak

19:57 2025-03-28 UTC+2

8

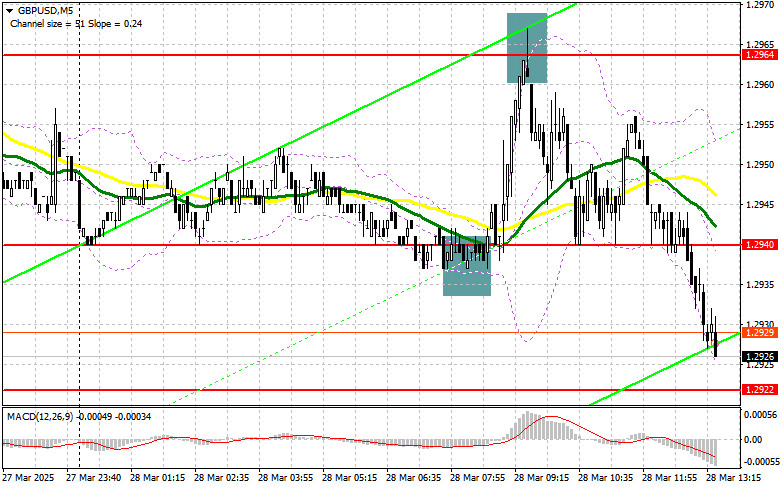

In my morning forecast, I focused on the level of 1.2964 and planned to make market entry decisions based on it. Let's look at the 5-minute chart and break downAuthor: Miroslaw Bawulski

19:54 2025-03-28 UTC+2

8

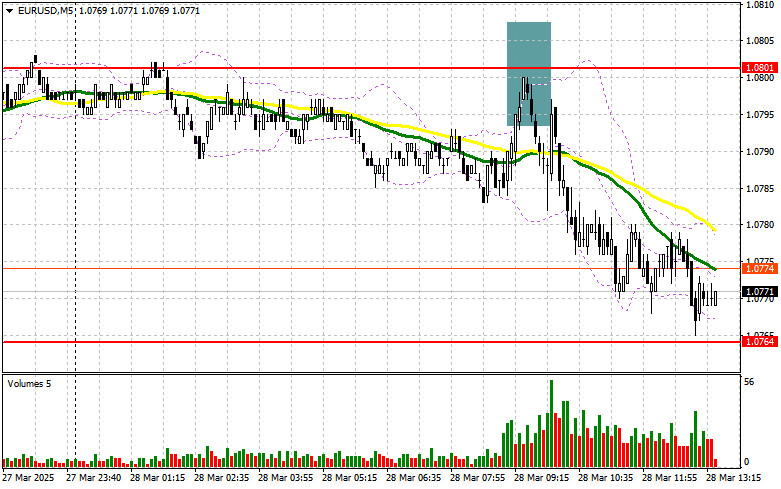

- In my morning forecast, I highlighted the level of 1.0801 and planned to base my market entries on it. Let's look at the 5-minute chart to see what happened

Author: Miroslaw Bawulski

19:52 2025-03-28 UTC+2

8

Technical analysisTrading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming daysAuthor: Dimitrios Zappas

15:12 2025-03-28 UTC+2

31

Technical analysisTrading Signals for EUR/USD for March 28-31, 2025: sell below 1.0775 (21 SMA - 6/8 Murray)

Early in the American session, the euro is trading around 1.0771, below the 21SMA, and within the downtrend channel forming since March 14. The bias is bearish. Yesterday, EUR/USD attemptedAuthor: Dimitrios Zappas

15:09 2025-03-28 UTC+2

15