交易员计算器

Take advantage of a trader’s calculator by InstaForex to estimate the following parameters:

- a margin size per trade

- a pip value

All you need to do is enter a few basic data such as a particular financial instrument, the currency of your account, a trade size in lots, and leverage. Hence, you can reckon a trading plan for 300+ trading instruments that will save a lot of your time.

If you want to use a trader’s calculator by InstaForex, you do not have to register in advance or install any software. Parameters entered are processed online. The company’s powerful servers ensure flawless connection so that a trader can instantly figure out the best market entry point and other variants of a trade.

Important!

A pip value for currency pairs is calculated based on the current exchange rate of a particular pair.

Please take notice that 1 lot with InstaForex equals 10,000 units of a base currency.

Here are formulas for calculating a pip value of currency pairs and CFDs.

Calculation of a pip value:

1. XXX/USD

Pip value = 1 * (number of lots)

2. USD/XXX

Pip value = 1 / (USD/XXX) * (number of lots)

3. AAA/BBB

A pip value = (AAA/USD) / (AAA/BBB) * (number of lots)

Calculation of a pip value for CFDs:

Pip value = number of contracts * contract size * tick value

Why does InstaForex suggest a lot size of 10,000 instead of a standard lot size of 100,000 units of a base currency?

InstaForex offers its clients an opportunity to trade Forex applying three lot sizes in parallel within the same trading account. Three lot sizes are designated as Micro Forex, Mini Forex, and Standard Forex. To put this technology into practice, the company introduced an unconventional lot size of 10,000 units. For example, if a trade size equals 0.01 lot, this makes a pip value as low as $0.01. In other words, this is an absolute minimum that allows holders of accounts with $5,000 - $10,000 to manage their risks with utmost efficiency. Besides, a lot size of 10,000 units simplifies calculations of a pip value when opening positions.

Look at the following trade parameters:

- Trade size is 0.01 InstaForex lot = pip value is $0.01

- Trade size is 0.1 InstaForex lot = pip value is $0.1

- Trade size is 1 InstaForex lot = pip value is $1

- Trade size is 10 InstaForex lots = pip value is $10

- Trade size is 100 InstaForex lots = pip value is $100

- Trade size is 1,000 InstaForex lots = pip value is $1,000

A pip value is specified in a base currency of a currency pair’s quote.

InstaForex lots ensure convenient calculations and the possibility of trading three lot sizes inside the common trading account. This is a major advantage of trading conditions with InstaForex.

See Also

From us with love: win $5,000 for Valentine's Day!

Valentine's Day is just around the corner — the perfect time to delight your loved ones with gifts. Of course, we could not miss out on this wonderful occasion, so we have launched the Chancy Deposit promotion just in time for the holiday, giving you the chance to win $5,000! Anyone can try their luck! All you need to do is just top up your trading account anytime from the start to the end of February, while the promotion is active. Grab your chance to receive a luxurious gift by February 14th! May fortune be on your side! Register.

- 2025-02-24 22:40:18Singapore's Consumer Prices Record a Steep Decline in JanuaryQuick show2025-02-24 22:40:18Inflation Eases in Singapore as CPI Slows to 1.2% in JanuaryQuick show2025-02-24 22:40:18Singapore's Core CPI Dips Sharply to 0.80% in January, Marking a Significant Decrease from DecemberQuick show2025-02-24 22:40:18Indonesia's M2 Money Supply Growth Accelerates to 5.9% in January 2025Quick show2025-02-24 22:40:18New Zealand Sees Turnaround in Credit Card Spending as Consumer Confidence ReturnsQuick show2025-02-24 22:40:18New Zealand Retail Sales See Modest Growth in Fourth Quarter of 2024Quick show2025-02-24 22:40:18New Zealand's Core Retail Sales Surge After Previous DeclineQuick show2025-02-24 22:40:18Retail Sales in New Zealand See a Recovery with 0.9% Growth in Q4 2024Quick show2025-02-24 22:40:18Qatar's Total Credit Growth Decline: A Year-Over-Year UpdateQuick show2025-02-24 22:40:18Israel's Industrial Output Surges in December: An Unexpected TurnaroundQuick show

- 2025-02-24 22:40:18Decline in Yields as U.S. 2-Year Treasury Note Auction Reaches 4.169%Quick show2025-02-24 22:40:18U.S. 6-Month Treasury Bill Yield Dips to 4.180% in Recent AuctionQuick show2025-02-24 22:40:18U.S. 3-Month Bill Auction Sees Slight Decline, Hitting 4.195%Quick show2025-02-24 22:40:18Dallas Fed Manufacturing Index Dips Sharply in February 2025Quick show2025-02-24 22:40:18Bank of Israel Maintains Steadfast Interest Rate at 4.50% Through February 2025Quick show2025-02-24 22:40:18French 6-Month BTF Auction Sees Slight Dip in RatesQuick show2025-02-24 22:40:18French 12-Month BTF Auction Sees Slight Decline in Interest RatesQuick show2025-02-24 22:40:18Yield Marginally Decreases at French 3-Month BTF AuctionQuick show2025-02-24 22:40:18Belgium's Business Climate Sees Slight Improvement in FebruaryQuick show2025-02-24 22:40:18Chicago Fed National Activity Index Dips to -0.03 in January 2025Quick show

- 2025-02-24 22:40:18Poland's M3 Money Supply Edges Up to 9.4% YoY in January 2025Quick show2025-02-24 22:40:18Bank Lending on the Rise in Kuwait: January Sees Increase to 4.81%Quick show2025-02-24 22:40:18Kuwait’s M2 Money Supply Rises to 4.56% in January 2025, Indicating Economic ResilienceQuick show2025-02-24 22:40:18Mexico's CPI Eases in February's First Half to 0.15%Quick show2025-02-24 22:40:18Mexico's Core CPI Sees Slight Dip in February Amidst Stable Economic ConditionsQuick show2025-02-24 22:40:18Brazil's Consumer Confidence Dips as Economic Uncertainty LoomsQuick show2025-02-24 22:40:18Euro Zone CPI Shows Minimal Change in January, Data Indicates Just a 0.01 UptickQuick show2025-02-24 22:40:18Euro Zone Core Inflation Dips in January 2025: A Closer Look at HICP Ex Energy and FoodQuick show2025-02-24 22:40:18Euro Zone's Core Inflation Holds Steady at 2.7% in JanuaryQuick show2025-02-24 22:40:18Euro Zone Inflation Dips into Deflation Territory as CPI Ex Tobacco Marks DeclineQuick show

- 2025-02-24 22:40:18Euro Zone CPI ex Tobacco Increases to 2.4% in January 2025Quick show2025-02-24 22:40:18Euro Zone Inflation Dips as CPI Drops to -0.3% in JanuaryQuick show2025-02-24 22:40:18Euro Zone Core CPI Drops Amidst Economic Concerns: January Sees a -0.9% DeclineQuick show2025-02-24 22:40:18Euro Zone January CPI Slightly Rises as Inflation Remains TepidQuick show2025-02-24 22:40:18Euro Zone Core CPI Remains Steady at 2.7% in JanuaryQuick show2025-02-24 22:40:18German Economic Optimism Inches Upwards in February as Business Climate Index Rises SlightlyQuick show2025-02-24 22:40:18Germany's Economic Confidence Dips Slightly in February 2025Quick show2025-02-24 22:40:18German Business Expectations Show Slight Improvement in FebruaryQuick show2025-02-24 22:40:18Poland's Retail Sales Surge: January Records 6.1% Increase YoYQuick show2025-02-24 22:40:18Taiwan's M3 Money Supply Climbs to New Heights in January 2025Quick show

- 2025-02-24 22:40:18Taiwan's M2 Money Supply Sees Slight Uptick in January 2025Quick show2025-02-24 22:40:18Austrian Harmonized Index of Consumer Prices Slightly Dips to 3.4% in JanuaryQuick show2025-02-24 22:40:18Austria's Inflation Rate Escalates to 3.18% in January 2025 Amid Economic PressuresQuick show2025-02-24 22:40:18Austrian CPI Sees Upward Momentum in January, Climbing to 1.04% Month-over-MonthQuick show2025-02-24 22:40:18Austrian HICP Remains Steady at 0.9% through January 2025Quick show2025-02-24 22:40:18Slovak Inflation Rate Records Significant Increase, Surging to 4.20% in JanuaryQuick show2025-02-24 22:40:18Slovakia's EU Normalized CPI Rises to 1.80% in January, Rebounds from December's DeclineQuick show2025-02-24 22:40:18Swiss Employment Rates Edge Up in Q4 2024, Continues Positive TrendQuick show2025-02-24 22:40:18Turkey's Manufacturing Confidence Reaches New High in FebruaryQuick show2025-02-24 22:40:18Turkey's Capacity Utilization Rate Experiences Slight Dip in FebruaryQuick show

- 2025-02-24 22:40:18Singapore's Consumer Prices Record a Steep Decline in JanuaryQuick show2025-02-24 22:40:18Inflation Eases in Singapore as CPI Slows to 1.2% in JanuaryQuick show2025-02-24 22:40:18Singapore's Core CPI Dips Sharply to 0.80% in January, Marking a Significant Decrease from DecemberQuick show2025-02-24 22:40:18Indonesia's M2 Money Supply Growth Accelerates to 5.9% in January 2025Quick show2025-02-24 22:40:18New Zealand Sees Turnaround in Credit Card Spending as Consumer Confidence ReturnsQuick show2025-02-24 22:40:18New Zealand Retail Sales See Modest Growth in Fourth Quarter of 2024Quick show2025-02-24 22:40:18New Zealand's Core Retail Sales Surge After Previous DeclineQuick show2025-02-24 22:40:18Retail Sales in New Zealand See a Recovery with 0.9% Growth in Q4 2024Quick show2025-02-24 22:40:18Qatar's Total Credit Growth Decline: A Year-Over-Year UpdateQuick show2025-02-24 22:40:18Israel's Industrial Output Surges in December: An Unexpected TurnaroundQuick show

- 2025-02-24 22:40:18Decline in Yields as U.S. 2-Year Treasury Note Auction Reaches 4.169%Quick show2025-02-24 22:40:18U.S. 6-Month Treasury Bill Yield Dips to 4.180% in Recent AuctionQuick show2025-02-24 22:40:18U.S. 3-Month Bill Auction Sees Slight Decline, Hitting 4.195%Quick show2025-02-24 22:40:18Dallas Fed Manufacturing Index Dips Sharply in February 2025Quick show2025-02-24 22:40:18Bank of Israel Maintains Steadfast Interest Rate at 4.50% Through February 2025Quick show2025-02-24 22:40:18French 6-Month BTF Auction Sees Slight Dip in RatesQuick show2025-02-24 22:40:18French 12-Month BTF Auction Sees Slight Decline in Interest RatesQuick show2025-02-24 22:40:18Yield Marginally Decreases at French 3-Month BTF AuctionQuick show2025-02-24 22:40:18Belgium's Business Climate Sees Slight Improvement in FebruaryQuick show2025-02-24 22:40:18Chicago Fed National Activity Index Dips to -0.03 in January 2025Quick show

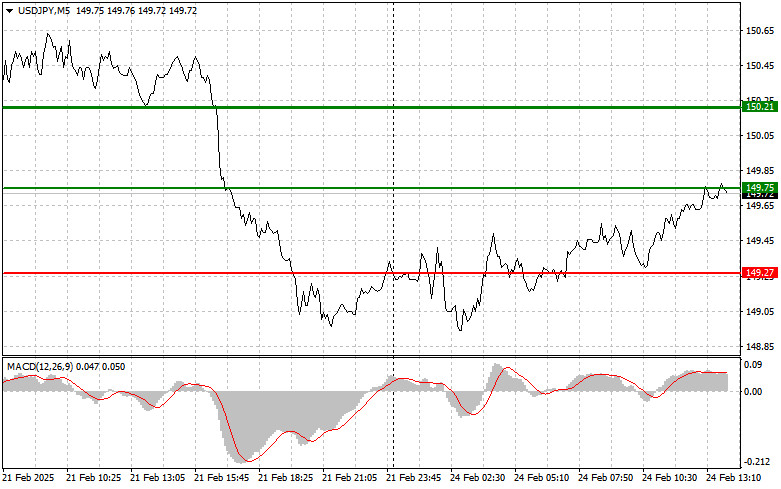

- The price test at 149.75 occurred when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upward potential. For this reason, I refrained from

Author: Jakub Novak

16:59 2025-02-24 UTC+2

6

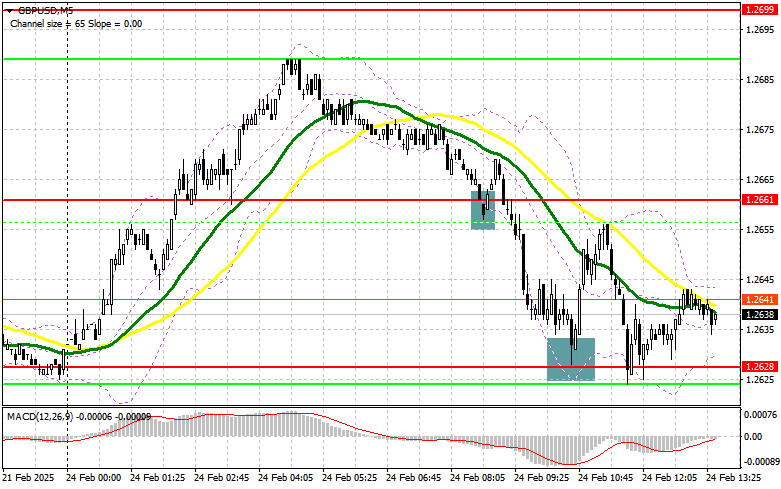

The price test at 1.2654 occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downward potential. For this reason, I refrained fromAuthor: Jakub Novak

16:57 2025-02-24 UTC+2

8

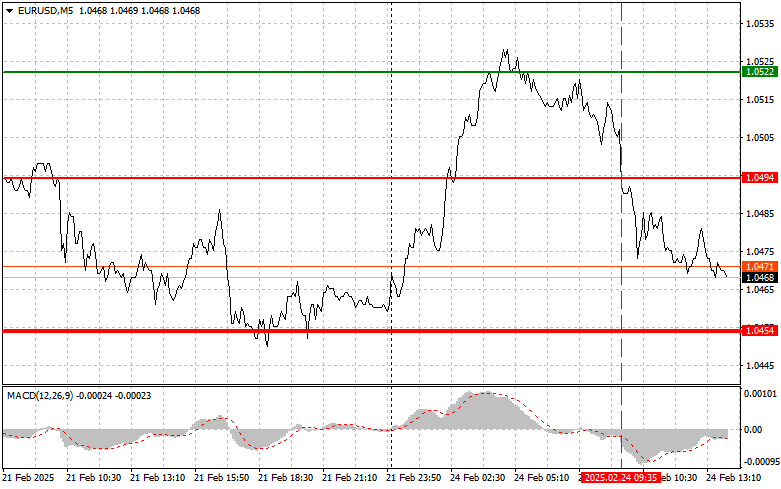

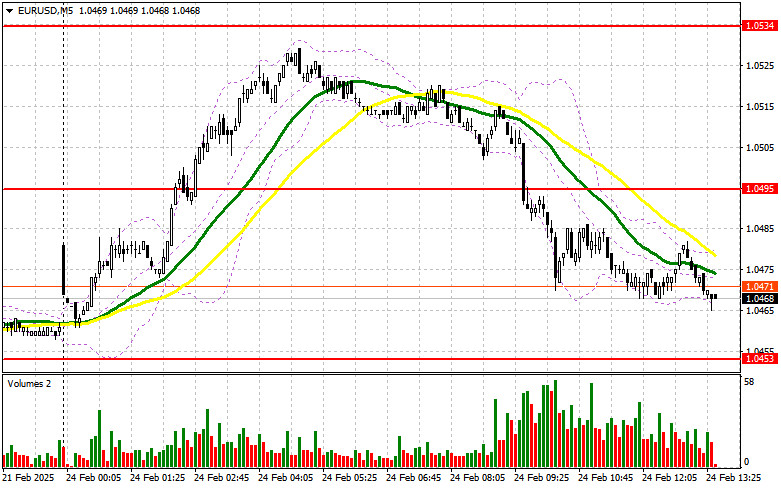

During the first half of the day, the price tested the 1.0494 level at a time when the MACD indicator had already moved significantly below the zero mark, which limitedAuthor: Jakub Novak

16:54 2025-02-24 UTC+2

7

- Trading plan

GBP/USD: Trading Plan for the U.S. Session on February 24th (Analysis of Morning Trades)

In my morning forecast, I focused on the 1.2628 level as a key decision point for market entry. Looking at the 5-minute chart, we can see that a false breakoutAuthor: Miroslaw Bawulski

16:51 2025-02-24 UTC+2

9

Trading planEUR/USD: Trading Plan for the U.S. Session on February 24th (Analysis of Morning Trades)

In my morning forecast, I focused on the 1.0495 level as a key decision point for market entry. Looking at the 5-minute chart, we can see that the price droppedAuthor: Miroslaw Bawulski

16:46 2025-02-24 UTC+2

4

Gold remains confined within a multi-day trading range, struggling to reach its historical high. Investor concerns over a potential global trade war triggered by tariffs imposed by U.S. President DonaldAuthor: Irina Yanina

16:42 2025-02-24 UTC+2

8

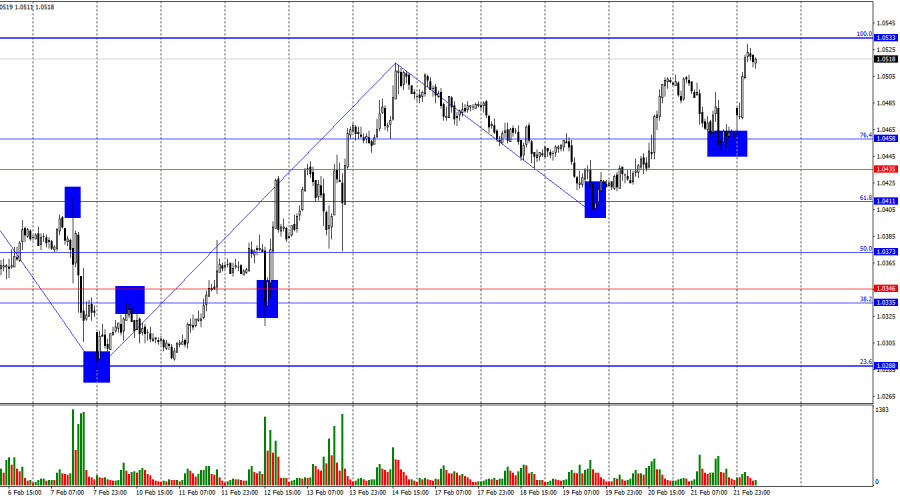

- At the start of the new week, the EUR/USD pair showed positive momentum, reaching nearly a one-month high around 1.0525–1.0530 during the Asian session. This movement is supported

Author: Irina Yanina

16:40 2025-02-24 UTC+2

8

On Friday, the EUR/USD pair retraced to the 76.4% Fibonacci correction level at 1.0458, rebounded, and reversed in favor of the euro. On Monday, a strong rally began, drivenAuthor: Samir Klishi

16:38 2025-02-24 UTC+2

7

The euro and the pound strengthened during the Asian session, updating last week's highs, indicating renewed demand for risk assets. The euro saw a surge in buying immediately afterAuthor: Jakub Novak

16:35 2025-02-24 UTC+2

10