交易员计算器

Take advantage of a trader’s calculator by InstaForex to estimate the following parameters:

- a margin size per trade

- a pip value

All you need to do is enter a few basic data such as a particular financial instrument, the currency of your account, a trade size in lots, and leverage. Hence, you can reckon a trading plan for 300+ trading instruments that will save a lot of your time.

If you want to use a trader’s calculator by InstaForex, you do not have to register in advance or install any software. Parameters entered are processed online. The company’s powerful servers ensure flawless connection so that a trader can instantly figure out the best market entry point and other variants of a trade.

Important!

A pip value for currency pairs is calculated based on the current exchange rate of a particular pair.

Please take notice that 1 lot with InstaForex equals 10,000 units of a base currency.

Here are formulas for calculating a pip value of currency pairs and CFDs.

Calculation of a pip value:

1. XXX/USD

Pip value = 1 * (number of lots)

2. USD/XXX

Pip value = 1 / (USD/XXX) * (number of lots)

3. AAA/BBB

A pip value = (AAA/USD) / (AAA/BBB) * (number of lots)

Calculation of a pip value for CFDs:

Pip value = number of contracts * contract size * tick value

Why does InstaForex suggest a lot size of 10,000 instead of a standard lot size of 100,000 units of a base currency?

InstaForex offers its clients an opportunity to trade Forex applying three lot sizes in parallel within the same trading account. Three lot sizes are designated as Micro Forex, Mini Forex, and Standard Forex. To put this technology into practice, the company introduced an unconventional lot size of 10,000 units. For example, if a trade size equals 0.01 lot, this makes a pip value as low as $0.01. In other words, this is an absolute minimum that allows holders of accounts with $5,000 - $10,000 to manage their risks with utmost efficiency. Besides, a lot size of 10,000 units simplifies calculations of a pip value when opening positions.

Look at the following trade parameters:

- Trade size is 0.01 InstaForex lot = pip value is $0.01

- Trade size is 0.1 InstaForex lot = pip value is $0.1

- Trade size is 1 InstaForex lot = pip value is $1

- Trade size is 10 InstaForex lots = pip value is $10

- Trade size is 100 InstaForex lots = pip value is $100

- Trade size is 1,000 InstaForex lots = pip value is $1,000

A pip value is specified in a base currency of a currency pair’s quote.

InstaForex lots ensure convenient calculations and the possibility of trading three lot sizes inside the common trading account. This is a major advantage of trading conditions with InstaForex.

See Also

- 2025-02-19 19:33:36UK Core PPI Output Rises 0.3% in January After Flat DecemberQuick show2025-02-19 19:33:36UK Core PPI Output Remains Steady at 1.5% Year-Over-Year in January 2025Quick show2025-02-19 19:33:36UK Core CPI Dips to -0.4% in January 2025, Signaling Potential Deflationary PressuresQuick show2025-02-19 19:33:36UK Consumer Price Index Rises to 3.0% in January, Marking an Uptick from December's 2.5%Quick show2025-02-19 19:33:36UK Core CPI Climbs to 3.7% in January: A Year-Over-Year SurgeQuick show2025-02-19 19:33:36Finnish Consumer Price Index Holds Steady at 0.7% Year-Over-Year in JanuaryQuick show2025-02-19 19:33:36Finland's CPI Rises to 0.20% in January: A Rebound from December's DeclineQuick show2025-02-19 19:33:36RBNZ's Offshore Holdings Slightly Rise in January, Marking a Stable OutlookQuick show2025-02-19 19:33:36China’s Housing Market Shows Slight Improvement as Prices Decline at Reduced PaceQuick show2025-02-19 19:33:36RBNZ Cuts Interest Rates to 3.75% as New Zealand Economy Faces SlowdownQuick show

- 2025-02-19 19:33:36Brazil's Foreign Exchange Flows Show Worrying Decline in FebruaryQuick show2025-02-19 19:33:36Atlanta Fed GDPNow Stagnates at 2.3% for First Quarter 2025Quick show2025-02-19 19:33:36Turkey's Central Government Debt Climbs: January Figures Show Increase to 9579.3 BillionQuick show2025-02-19 19:33:36U.S. Retail Sales Spike to 6.3% Year-Over-Year Increase, Redbook ShowsQuick show2025-02-19 19:33:36US Housing Starts Plummet by 9.8% in January, Marking a Sharp Reversal from DecemberQuick show2025-02-19 19:33:36U.S. Building Permits Show Tepid Improvement in January, Marking a Positive Shift after DeclineQuick show2025-02-19 19:33:36US Housing Starts Dip in January, Reflecting Market AdjustmentsQuick show2025-02-19 19:33:36U.S. Building Permits Edge Up Slightly Despite Economic UncertaintyQuick show2025-02-19 19:33:36US Mortgage Refinance Index Declines as Rates Bite HomeownersQuick show2025-02-19 19:33:36U.S. Mortgage Market Index Dips to Lowest Point Since 2024Quick show

- 2025-02-19 19:33:36U.S. MBA Purchase Index Declines to 144.0, Signaling Potential Housing Market SlowdownQuick show2025-02-19 19:33:36U.S. MBA 30-Year Mortgage Rate Sees Marginal Decline to 6.93% in FebruaryQuick show2025-02-19 19:33:36US Mortgage Applications Plummet as Market Pressures IntensifyQuick show2025-02-19 19:33:36Serbia's CPI Rises to 4.60% in January 2025Quick show2025-02-19 19:33:36Irish Residence Property Prices Retreat Slightly in DecemberQuick show2025-02-19 19:33:36Irish Residential Property Prices Cool Down in DecemberQuick show2025-02-19 19:33:36Serbian CPI Surges to 0.60% in January: A Substantial MoM IncreaseQuick show2025-02-19 19:33:36South Africa Retail Sales Growth Slows Sharply in DecemberQuick show2025-02-19 19:33:36Portuguese Current Account Sees Decline in December 2024Quick show2025-02-19 19:33:36German Bund Yields Edge Lower: Auction Reflects Subtle Economic AdjustmentsQuick show

- 2025-02-19 19:33:36UK 4-Year Treasury Gilt Auction Yields Dip Slightly to 4.294%Quick show2025-02-19 19:33:36Ghana's Producer Price Index Jumps to 28.50% Amid Inflation PressuresQuick show2025-02-19 19:33:36China Sees Improvement in FDI Inflows as Negative Trend SlowsQuick show2025-02-19 19:33:36UK House Price Index Surges to 4.6%: A Significant Year-Over-Year IncreaseQuick show2025-02-19 19:33:36Euro Zone Current Account Surplus Surges to 50.5 Billion Euros in DecemberQuick show2025-02-19 19:33:36Euro Zone Current Account Surplus Surges to €38.4 Billion in DecemberQuick show2025-02-19 19:33:36Indonesia Holds Lending Facility Rate Steady at 6.50% in FebruaryQuick show2025-02-19 19:33:36Indonesia Holds Steady on Interest Rates Amid Global Economic UncertaintyQuick show2025-02-19 19:33:36Bank Indonesia Maintains Steady Deposit Facility Rate at 5.00%Quick show2025-02-19 19:33:36Indonesia Sees Loan Growth Ease Slightly in January 2025Quick show

- 2025-02-19 19:33:36UK's Retail Price Index Inches Upward in January 2025: Yearly Growth Takes a Slight LeapQuick show2025-02-19 19:33:36UK Retail Price Index Slips into Negative Territory in January 2025Quick show2025-02-19 19:33:36UK PPI Output Surges to 0.5% in January, Reversing December DeclineQuick show2025-02-19 19:33:36UK PPI Output Shows Positive Uptick in January 2025, Ending Decline TrendQuick show2025-02-19 19:33:36UK PPI Input Marks Significant Recovery: Narrow Decline in January 2025Quick show2025-02-19 19:33:36UK PPI Input Surges to 0.8% in January, Up from December's 0.2%Quick show2025-02-19 19:33:36UK Consumer Price Index Indicates Slight Downturn as 2025 BeginsQuick show2025-02-19 19:33:36United Kingdom's Consumer Price Index Falls Into Negative Territory in JanuaryQuick show2025-02-19 19:33:36United Kingdom's Core RPI Rises to 3.2% in January 2025, Surpassing December's 2.9%Quick show2025-02-19 19:33:36United Kingdom's Core RPI Turns Negative in January 2025Quick show

- 2025-02-19 19:33:36UK Core PPI Output Rises 0.3% in January After Flat DecemberQuick show2025-02-19 19:33:36UK Core PPI Output Remains Steady at 1.5% Year-Over-Year in January 2025Quick show2025-02-19 19:33:36UK Core CPI Dips to -0.4% in January 2025, Signaling Potential Deflationary PressuresQuick show2025-02-19 19:33:36UK Consumer Price Index Rises to 3.0% in January, Marking an Uptick from December's 2.5%Quick show2025-02-19 19:33:36UK Core CPI Climbs to 3.7% in January: A Year-Over-Year SurgeQuick show2025-02-19 19:33:36Finnish Consumer Price Index Holds Steady at 0.7% Year-Over-Year in JanuaryQuick show2025-02-19 19:33:36Finland's CPI Rises to 0.20% in January: A Rebound from December's DeclineQuick show2025-02-19 19:33:36RBNZ's Offshore Holdings Slightly Rise in January, Marking a Stable OutlookQuick show2025-02-19 19:33:36China’s Housing Market Shows Slight Improvement as Prices Decline at Reduced PaceQuick show2025-02-19 19:33:36RBNZ Cuts Interest Rates to 3.75% as New Zealand Economy Faces SlowdownQuick show

- 2025-02-19 19:33:36Brazil's Foreign Exchange Flows Show Worrying Decline in FebruaryQuick show2025-02-19 19:33:36Atlanta Fed GDPNow Stagnates at 2.3% for First Quarter 2025Quick show2025-02-19 19:33:36Turkey's Central Government Debt Climbs: January Figures Show Increase to 9579.3 BillionQuick show2025-02-19 19:33:36U.S. Retail Sales Spike to 6.3% Year-Over-Year Increase, Redbook ShowsQuick show2025-02-19 19:33:36US Housing Starts Plummet by 9.8% in January, Marking a Sharp Reversal from DecemberQuick show2025-02-19 19:33:36U.S. Building Permits Show Tepid Improvement in January, Marking a Positive Shift after DeclineQuick show2025-02-19 19:33:36US Housing Starts Dip in January, Reflecting Market AdjustmentsQuick show2025-02-19 19:33:36U.S. Building Permits Edge Up Slightly Despite Economic UncertaintyQuick show2025-02-19 19:33:36US Mortgage Refinance Index Declines as Rates Bite HomeownersQuick show2025-02-19 19:33:36U.S. Mortgage Market Index Dips to Lowest Point Since 2024Quick show

From us with love: win $5,000 for Valentine's Day!

Valentine's Day is just around the corner — the perfect time to delight your loved ones with gifts. Of course, we could not miss out on this wonderful occasion, so we have launched the Chancy Deposit promotion just in time for the holiday, giving you the chance to win $5,000! Anyone can try their luck! All you need to do is just top up your trading account anytime from the start to the end of February, while the promotion is active. Grab your chance to receive a luxurious gift by February 14th! May fortune be on your side! Register.

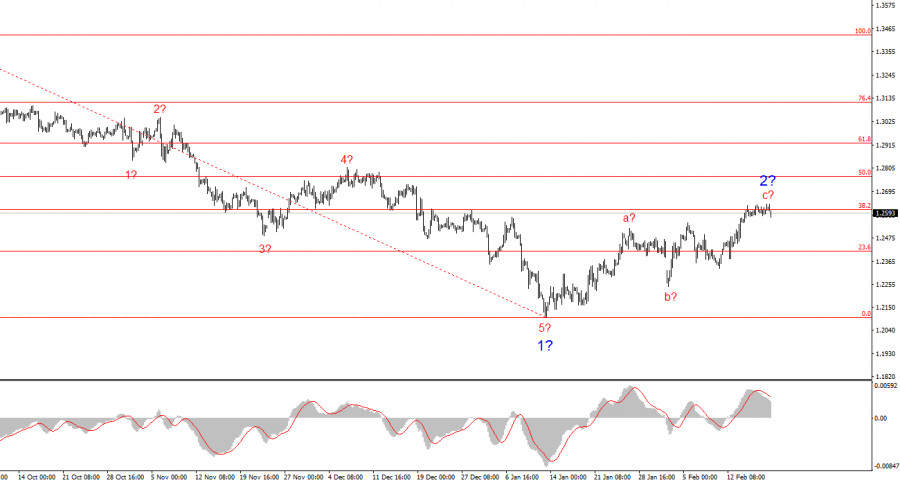

- The wave pattern for GBP/USD remains somewhat ambiguous but generally clear. There is still a high probability of a long-term downward trend, though some uncertainty surrounds the assumed wave

Author: Chin Zhao

19:21 2025-02-19 UTC+2

0

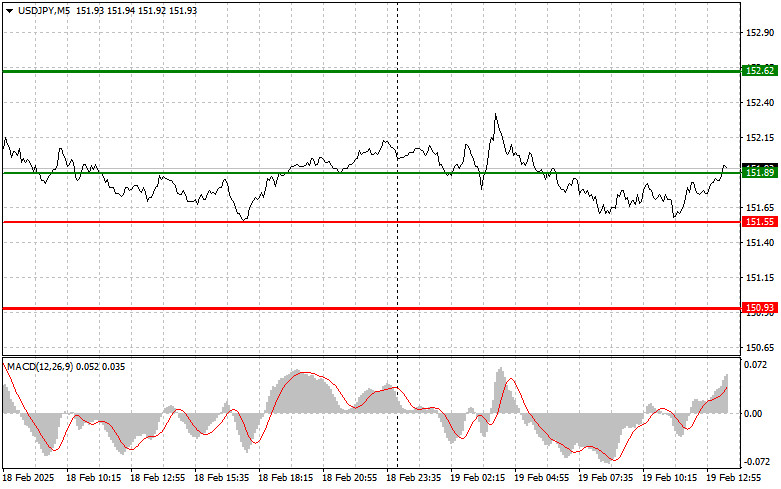

The price test at 151.89 occurred when the MACD indicator had already moved significantly above the zero mark, limiting the pair's upward potential—especially in the bearish market environment observed recentlyAuthor: Jakub Novak

19:17 2025-02-19 UTC+2

0

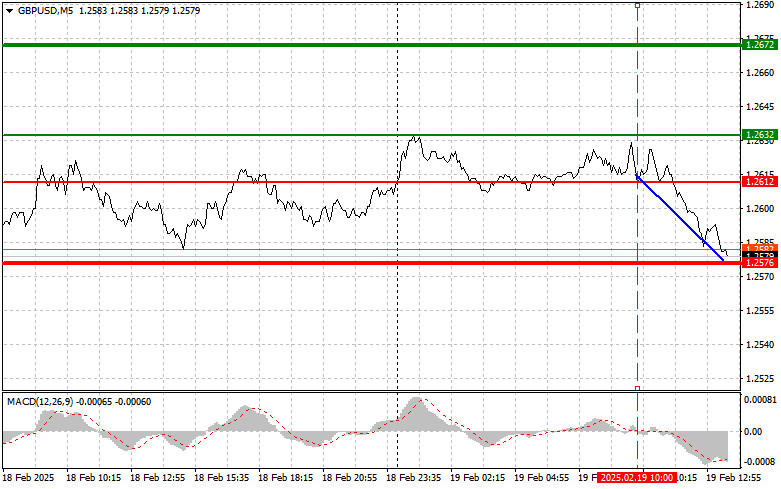

The price test at 1.2612 occurred when the MACD indicator started moving downward from the zero mark, confirming a valid sell entry for GBP/USD, which resulted in a 35-point declineAuthor: Jakub Novak

19:14 2025-02-19 UTC+2

1

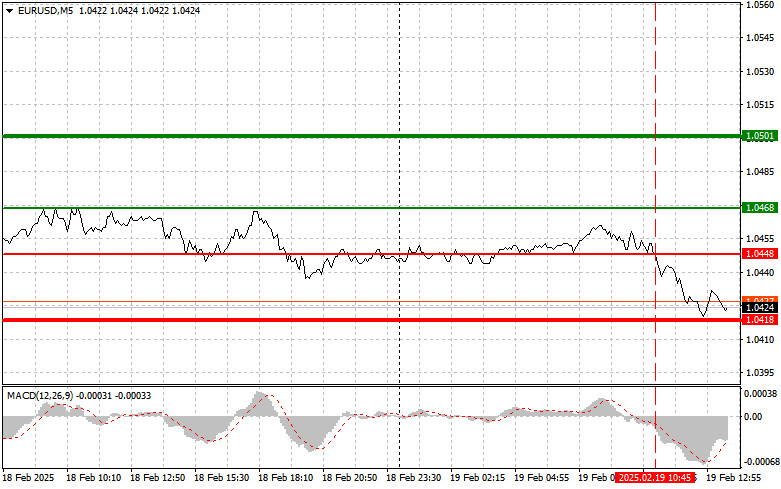

- The price test at 1.0448 in the first half of the day coincided with a moment when the MACD indicator had already moved significantly downward from the zero mark, limiting

Author: Jakub Novak

19:12 2025-02-19 UTC+2

0

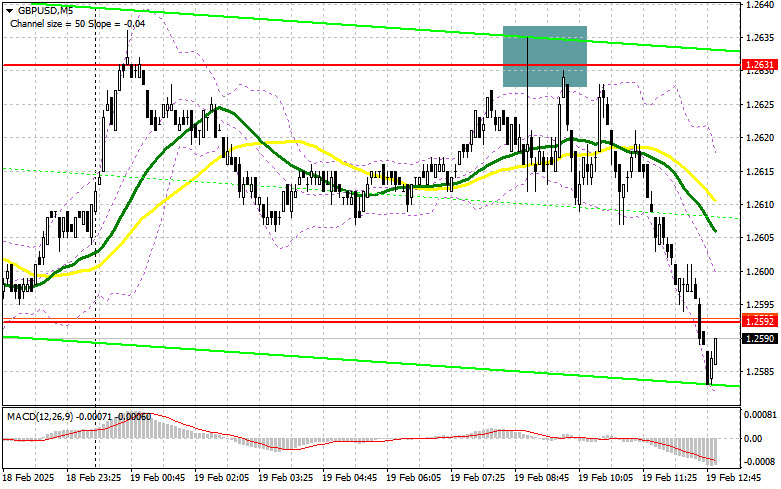

In my morning analysis, I focused on 1.2631 as a key level for making trading decisions. A rise followed by a false breakout at this level provided an ideal scenarioAuthor: Miroslaw Bawulski

19:06 2025-02-19 UTC+2

1

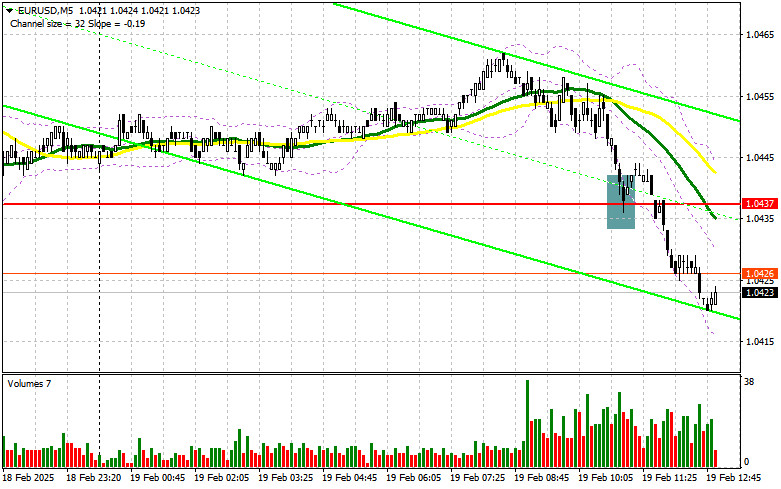

In my morning analysis, I highlighted the 1.0437 level as a key decision point for entering the market. Reviewing the five-minute chart, a false breakout occurred around this level, providingAuthor: Miroslaw Bawulski

19:02 2025-02-19 UTC+2

0

- Silver continues its bullish momentum, attracting buyers on pullbacks from the $32.00 psychological level. The metal has now posted gains for three consecutive days, reaching a new weekly high

Author: Irina Yanina

18:59 2025-02-19 UTC+2

0

Today, USD/CAD encountered fresh selling pressure, pausing its two-day recovery from a two-month low. Investor expectations for a March rate cut by the Bank of Canada (BoC) have diminished followingAuthor: Irina Yanina

18:56 2025-02-19 UTC+2

0

On Tuesday, EUR/USD continued its decline toward the 1.0435 level. A rebound from this level provided some support for the euro, but overall market activity remained subdued at the startAuthor: Samir Klishi

18:50 2025-02-19 UTC+2

28