The EUR/USD currency pair began showing a semblance of a downward correction between Wednesday and Thursday. The price has consolidated below the moving average on the 4-hour chart, but it's worth noting that this consolidation doesn't mean much for now — the uptrend remains too strong and stable, while the pullback is relatively shallow. Bears had more hope in the Federal Reserve's policy meeting, but they only have themselves to blame for the pair's failure to show a solid downward move.

In yesterday's article, we mentioned that the outcome of the Fed meeting should be assessed no earlier than the next day. For example, the U.S. dollar continued to strengthen on Thursday morning despite showing little reaction on Wednesday evening. This happened because European traders hadn't yet priced in the meeting — the European trading session had already closed. Overall, the dollar did appreciate slightly, but the move was clearly forced and unconvincing. The market seemed to have no choice but to buy the dollar — so it did. Technically, however, the picture doesn't even resemble the start of a proper downward correction.

As for the Fed meeting results, they can be interpreted as positive for the U.S. dollar. Consider the following:

- The inflation forecast was revised upward, which means inflation is expected to remain above target, and therefore, the Fed will need to cut rates more slowly.

- The economic growth forecast was revised downward, but this is not the same as it would be for the European Central Bank. In the U.S., even after a slowdown in Q4, the economy is still growing steadily. A further deceleration will not be critical.

The Fed doesn't need to "save" the economy because it doesn't require saving. Jerome Powell clearly stated there's no rush to cut the key rate. The dot plot still shows two rate cuts expected in 2025, just as before—but now, more officials support a scenario with no easing at all over the next nine months.

Almost every key point from the Fed's meeting favored the dollar. Under normal conditions, we would have seen a strong rally in the U.S. currency. But today's market is actively avoiding the U.S. dollar, so the growth was weak and symbolic.

What's next? Either a renewed decline in the dollar or a continuation of this strained upward move. The market continues to signal that it wants nothing to do with a currency tied to a country pursuing aggressive and protectionist policies. Trump is not stopping, and the dollar's sell-off increasingly looks like a protest against the U.S. president.

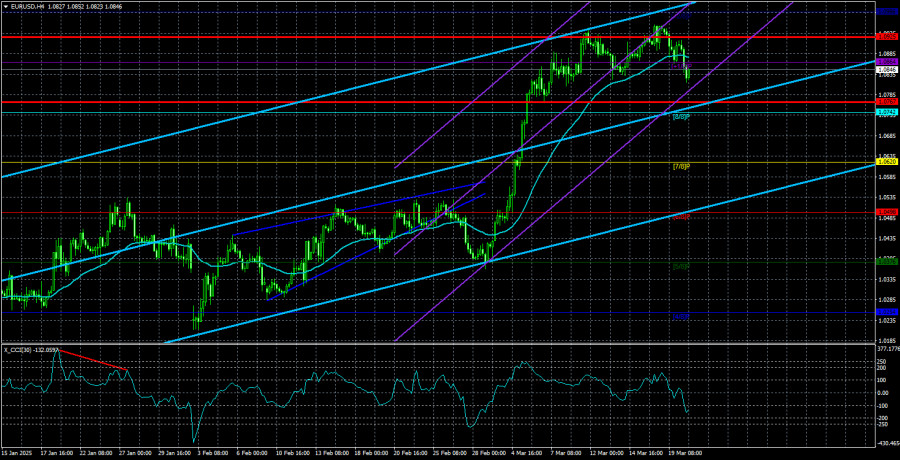

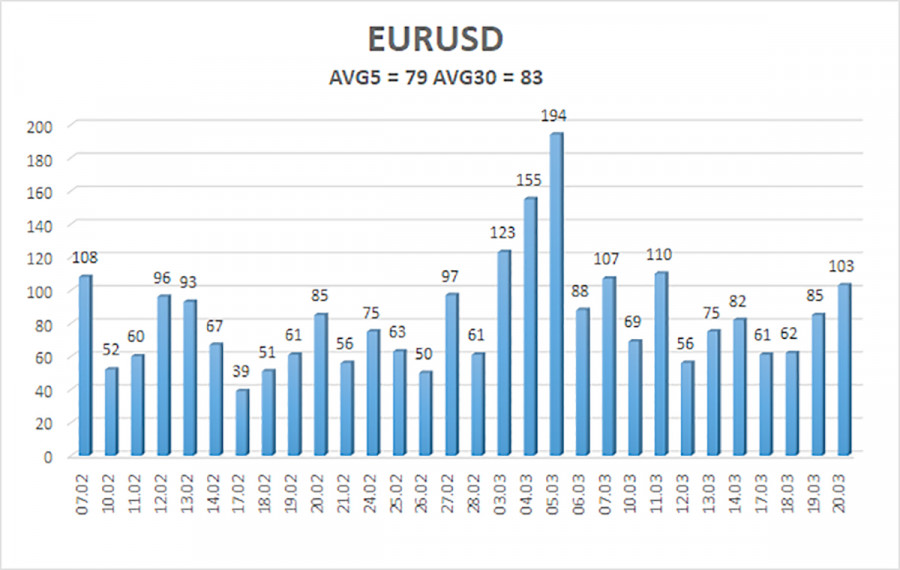

The average volatility of the EUR/USD currency pair over the last five trading days (as of March 21) is 79 pips, which is considered "moderate." We expect the pair to trade between 1.0767 to 1.0925 on Friday. The long-term regression channel has turned upward, but the global downtrend remains intact, as seen in higher timeframes. The CCI indicator has not recently entered overbought or oversold territory.

Nearest Support Levels:

S1 – 1.0742

S2 – 1.0620

S3 – 1.0498

Nearest Resistance Levels:

R1 – 1.0864

R2 – 1.0986

Trading Recommendations:

The EUR/USD pair has exited the sideways channel and continues to rise. For months, we've been reiterating that the euro is due for a medium-term decline, and nothing has changed in that outlook. The dollar still has no valid reason for a sustained medium-term drop other than Donald Trump. Short positions remain more attractive, with targets at 1.0315 and 1.0254, but it is difficult to predict when this illogical upward move will end. If you trade purely on technical signals, long positions may be considered if the price holds above the moving average, with targets at 1.0925 and 1.0986.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.